Premium Only Content

NVAX Stock Down More Than 50% - Still Generate Cashflow | Covered Calls | Cash Secured Puts

NOT INVESTMENT ADVICE - EDUCATION AND ENTERTAINMENT PURPOSES ONLY!!!

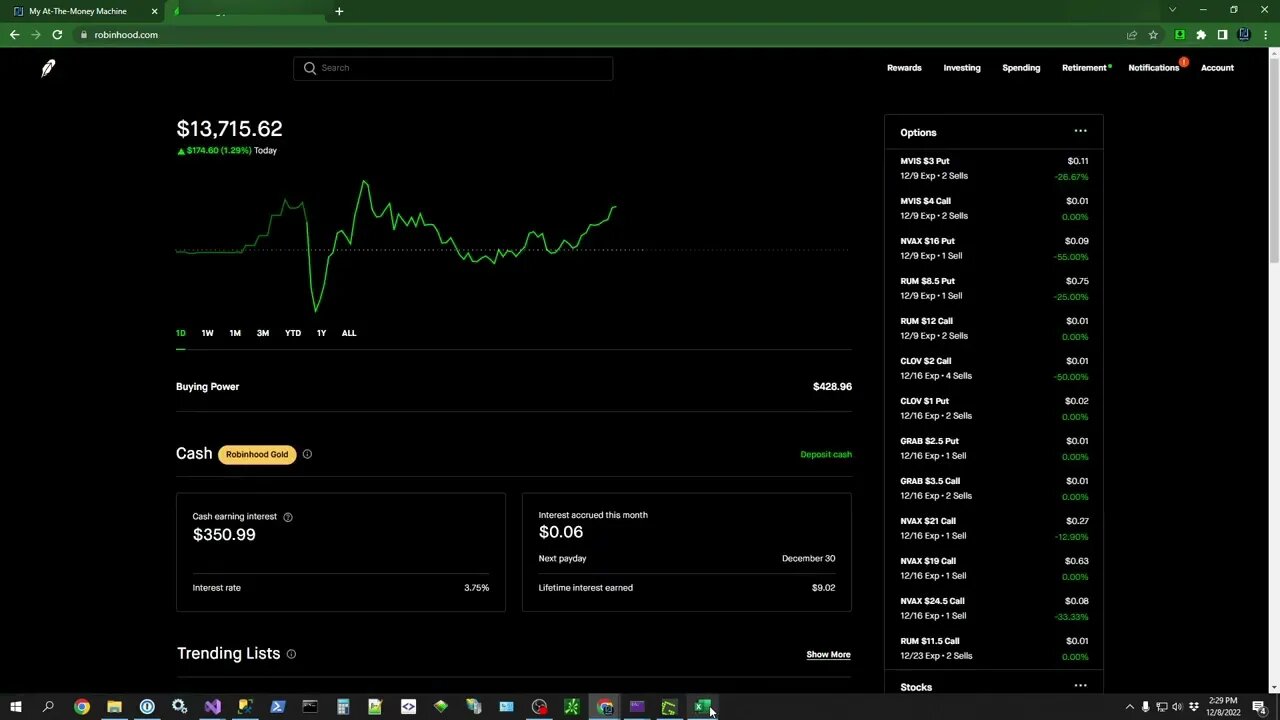

In this video, I explain how since I initially purchased 100 shares of NVAX stock, it has tanked down to more than 50% lower than it started out at... bought for around $40 per share, currently trading around $16.50... But I'm still able to generate weekly cashflow on this stock due to selling Cash-Secured Puts as it continued to fall in price AND ALSO selling Covered Calls at price points where previous Cash-Secured Puts were assigned.

Long-term continuing to be able to sell options for premium will outweigh unrealized capital loss on paper. We still own the shares, so we can continue to sell options for premium.

Having a tool to closely track our cost basis with and without premium is vital to being able to play this to our advantage.

Get Your FREE Account today at MyATMM.com - 2022.12.08

-

12:46

12:46

At-The-Money Options Trading Strategy

4 months ago $0.06 earnedBitcoin in Stock Market - BITO ETF - Using Covered Calls & Cash Secured Puts - Weekly Income

98 -

2:46:06

2:46:06

DDayCobra

7 hours ago $13.60 earnedCobraCast 199

50.3K4 -

2:07:27

2:07:27

TheSaltyCracker

7 hours agoTrump Tower Bombed w/ Cybertruck ReeEEeE Stream 01-01-25

148K279 -

8:15:58

8:15:58

FreshandFit

13 hours agoElon Musk BETRAYAL & Mass Censorship On X

197K81 -

2:25:43

2:25:43

Darkhorse Podcast

14 hours agoLooking Back and Looking Forward: The 258 Evolutionary Lens with Bret Weinstein and Heather Heying

156K209 -

5:50:16

5:50:16

Pepkilla

13 hours agoRanked Warzone ~ Are we getting to platinum today or waaa

105K7 -

9:15:09

9:15:09

BrancoFXDC

11 hours ago $8.93 earnedHAPPY NEW YEARS - Road to Platinum - Ranked Warzone

92.7K4 -

5:53

5:53

SLS - Street League Skateboarding

5 days agoBraden Hoban’s San Diego Roots & Hometown Win | Kona Big Wave “Beyond The Ride” Part 2

99.9K13 -

6:03:57

6:03:57

TheBedBug

16 hours ago🔴 LIVE: EPIC CROSSOVER - PATH OF EXILE 2 x MARVEL RIVALS

100K9 -

1:12:45

1:12:45

The Quartering

13 hours agoTerror In New Orleans, Attacker Unmasked, Tesla BLOWS UP At Trump Tower! Are We Under Attack?

163K261