Premium Only Content

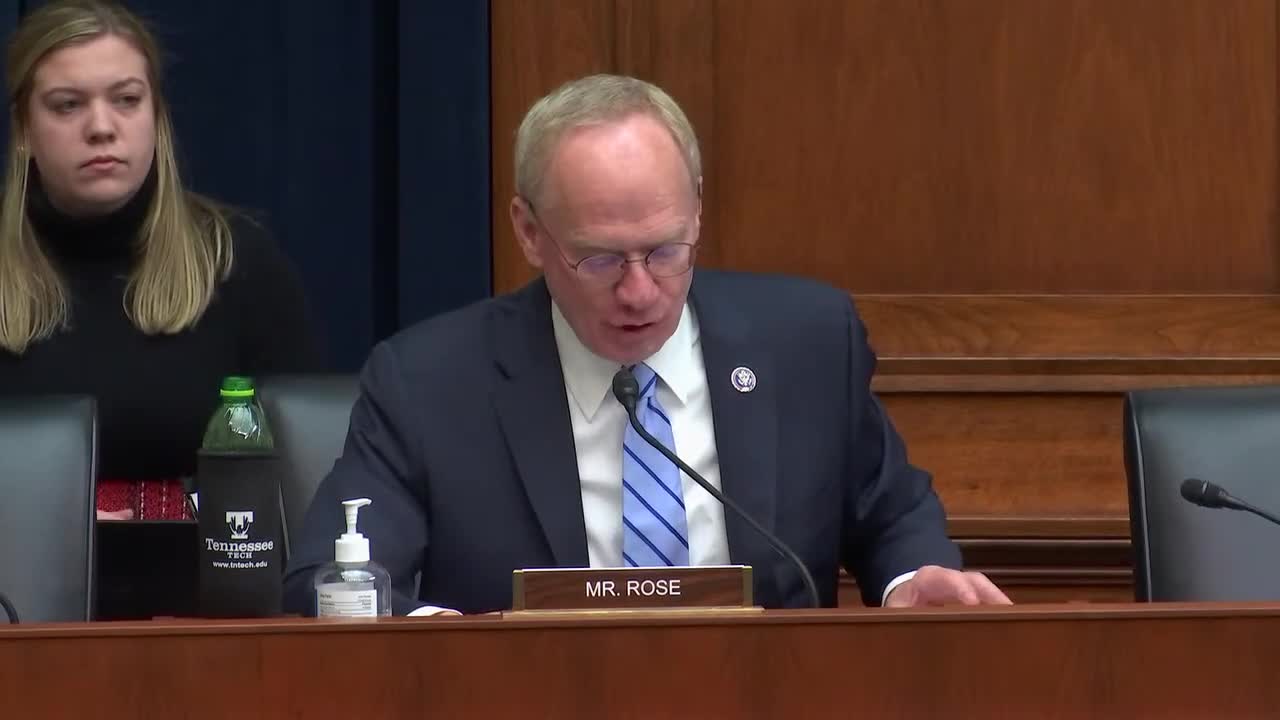

U.S. House Committee on Financial Services: Unfinished Business: A Review of Progress Made and a Plan to Achieve Full Economic Inclusion for Every American

On Tuesday, December 6, 2022, at 11:00 a.m. (ET) Diversity and Inclusion Subcommittee Chairwoman Beatty and Ranking Member Wagner will host a hybrid hearing entitled, “Unfinished Business: A Review of Progress Made and a Plan to Achieve Full Economic Inclusion for Every American."

Witnesses for this one-panel hearing will be:

• LeRoy Cavazos-Reyna, Vice President of Government and International Affairs, United States Hispanic Chamber of Commerce

• Debra Gore-Mann, President and Chief Executive Officer, Greenlining Institute

• Carolynn Johnson, Chief Executive Officer, DiversityInc

• Marc Morial, President and Chief Executive Officer, National Urban League

• Daniel Garcia-Dias, Managing Director, Financial Markets & Community Investment, U.S. Government Accountability Office

Overview

This hearing will review the progress towards full economic inclusion for all in the financial services industry and capital markets since the creation of the Subcommittee on Diversity and Inclusion in January 2019. Since its establishment, the Subcommittee has analyzed the racial and gender wealth gap, 2the state of diversity within the financial services industry, and barriers to economic inclusion for women, people of color, people with disabilities, the LGBTQ+ community, and justice-involved individuals.

Financial Sector Diversity

The Subcommittee on Diversity and Inclusion has investigated the state of diversity and inclusion in the financial services industry, requesting data from America’s largest banks, investment firms, and insurance companies. In total, the Subcommittee reviewed and analyzed data from the 44 largest banks with more than $50 billion in assets, the 31 largest investment firms with more than $400 billion in assets, and the 27 largest insurance companies that received direct premiums of more than $7 billion. The Committee on Financial Services published reports summarizing the state of diversity in each of these industries and proposed recommendations to improve workforce and supplier diversity.

Key Findings from the Committee’s Reports

1. Executive Leadership: The executive level is overwhelmingly White and male. Just 29% of executive leaders were women at the largest banks, 27.5% at the largest investment firms and 34% at the largest

insurance companies. On average, just 19% of executive leaders were people of color at the largest banks, 17.3% at the largest investment firms, and 16.2% at the largest insurance companies.

2. Board Leadership: The boards of large banks were on average just 30% women, at the largest investment firms 28% women and at the insurance companies 28.5% women. The boards of the large banks were on average just 20% racially and ethnically diverse, at the investment firms 17.5% racially and ethnically diverse; and at the insurance companies 22.3% racially and ethnically diverse.

3. Engagement of Diverse Businesses and Asset Managers: Large banks had limited spending and investments with diverse firms. All responding investment firms reported spending less than 4% of asset manager spending with women-owned or minority-owned firms. On average, responding insurance companies spent less than 3% of spend with diverse suppliers.

Many financial institutions have implemented new policies in response to the push for diversity and inclusion and following the formation of the Subcommittee on Diversity and Inclusion, resulting in greater representation for women and people of color at the start of 2021 compared to 2018. Despite this progress, representation continues to decline at every step of the corporate ladder, particularly for women of color (Black, Latina, and Asian) whose representation falls by 80% as they seek to fill more senior roles. Representation of women and people of color in the financial services industry trails their representation in the general population; women are 50.5% of the population and people of color are 40.7%. These statistics indicate that the financial industry still has work to do to achieve equal opportunity across the board.

Small Businesses

The Subcommittee examined the unique challenges that minority- and women-owned businesses (MWBEs) face when accessing capital and financial services.16 MWBEs encounter distinct barriers to market entry, including limited access to capital and persistent discrimination compared to majorityowned firms.17 The Subcommittee investigated how systemic inequalities led to disparate impacts during the Covid-19 pandemic and found that MWBEs were twice as likely to be classified as “at risk” or ...

-

5:36

5:36

R.C. Davis

5 days agoBiden admin is trying to ‘gaslight’ the American people: Ted Cruz

99 -

6:58

6:58

Gun Owners Of America

1 day ago2024 Was Huge For Gun Rights, Here's Our Top 10 Wins!

25.7K1 -

15:50

15:50

Degenerate Jay

1 day ago $1.28 earnedJames Bond Is Being Ruined By Amazon? Make Him A Black Gay Woman?

19.7K7 -

15:18

15:18

DeVory Darkins

1 day ago $12.04 earnedTrump Drops NIGHTMARE Warning on Joe Biden

36K43 -

36:13

36:13

The Why Files

1 month agoAlien Implants Vol. 1: Devil’s Den UFO Encounter: What Was Found Inside Terry Lovelace?

67.6K39 -

9:03

9:03

Alabama Arsenal

1 day ago $0.36 earnedAAC HUB 2K | Modern Features, Iconic Classic Looks

9.7K1 -

13:49

13:49

Dermatologist Dr. Dustin Portela

1 day ago $0.67 earnedDermatologist Reveals the Worst Things To Do To Your Skin

7.96K1 -

1:02:24

1:02:24

PMG

23 hours ago $0.22 earned"Hannah Faulkner and Jamie Villamor | DEFEND, INSPIRE, INFLUENCE"

6.56K -

44:27

44:27

BIG NEM

14 hours agoWOULD YOU RATHER? Live Stream

4.46K -

4:23:49

4:23:49

FreshandFit

16 hours agoIsrael v Palestine Debate! Respect A Man If He Says No Or Yes To A Girl's Trip?

196K217