Premium Only Content

End of Year Tax Planning Strategies for 2022

As the end of 2022 approaches, it leaves just a few weeks to complete some essential tax planning before it's too late. Roth Conversions, tax loss harvesting, and depreciation planning are just a few that you need to consider before the end of the year. We're joined by CPA Ryan Fair to break down these items and more in this episode of the Wise Money Show.

Have a question you want to be answered on the show? Call or text 574-222-2000 or leave a comment!

Want to speak with a Certified Financial Planner™? Visit https://www.korhorn.com/ or call 574-247-5898.

Find more information about the Wise Money Show™ at https://www.korhorn.com/wise-money-show

Be sure to stay up to date by following us!

Facebook - https://www.facebook.com/WiseMoneyShow

Instagram - https://www.instagram.com/wisemoneyshow/

Twitter - https://twitter.com/WiseMoneyShow

Want more Wise Money™?

Read our blog! https://www.korhorn.com/wise-money-blog

Listen on Podcast: https://link.chtbl.com/WiseMoney

Subscribe on YouTube: http://www.youtube.com/c/WiseMoneyShow

Kevin Korhorn, CFP® offers securities through Silver Oak Securities, Inc., Member FINRA/SIPC. Kevin offers advisory services through KFG Wealth Management, LLC dba Korhorn Financial Group. KFG Wealth Management, LLC dba Korhorn Financial Group and Silver Oak Securities, Inc. are not affiliated. Mike Bernard, CFP® and Joshua Gregory, CFP® offer advisory services through KFG Wealth Management, LLC dba Korhorn Financial Group. This information is for general financial education and is not intended to provide specific investment advice or recommendations. All investing and investment strategies involve risk including the potential loss of principal. Asset allocation & diversification do not ensure a profit or prevent a loss in a declining market. Past performance is not a guarantee of future results.

Intro: (0:00)

Segment 1: (0:11)

Break 1: (10:29)

Segment 2: (13:47)

Break 2: (24:04)

Segment 3: (24:40)

Break 3: (34:53)

Segment 4 (35:59)

Outro: (46:11)

-

10:57

10:57

Wise Money Show

11 months ago $0.06 earnedDo 401k Contributions Avoid FICA Tax?

45 -

1:48:50

1:48:50

Glenn Greenwald

7 hours agoDC Attacks Trump's Most Disruptive Picks; Biden Authorizes Massive Escalation With Russia; Joe & Mika Meet With "Hitler" | SYSTEM UPDATE #367

121K130 -

1:44:34

1:44:34

Tucker Carlson

7 hours agoTucker Carlson and Russ Vought Break Down DOGE and All of Trump’s Cabinet Picks So Far

169K231 -

1:42:47

1:42:47

Flyover Conservatives

23 hours agoBO POLNY | The Best and Worst Times Are Coming – Are You Ready? | FOC Show

36.3K15 -

51:12

51:12

BIG NEM

9 hours agoWelcome to Our Uncensored Show: Trump, Simulation Theory & the Albanian Mob - EP1

49.4K12 -

2:05:14

2:05:14

Robert Gouveia

8 hours agoFBI Criminals Get LAWYERS; STOP Counting ILLEGAL Votes; Time to Disbar Tish James

66.1K97 -

1:00:30

1:00:30

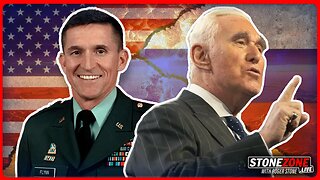

The StoneZONE with Roger Stone

7 hours agoAre We Heading For World War III? General Michael Flynn Joins The StoneZONE w/ Roger Stone

46.5K11 -

1:14:12

1:14:12

We Like Shooting

16 hours ago $1.23 earnedDouble Tap 384 (Gun Podcast)

22.5K -

4:17:21

4:17:21

Tundra Gaming Live

9 hours ago $2.22 earnedThe Worlds Okayest War Thunder Stream

34.6K2 -

1:20:47

1:20:47

Donald Trump Jr.

10 hours agoThe MAGA Cultural Shift, Plus UFC at MSG & Interview with Newt Gingrich | TRIGGERED Ep.192

155K191