Premium Only Content

1913 Federal Reserve Act

On December 13, 1913, American life was forever changed. Prior to 1913, the United States had only had an income tax on the most affluent, during the American Civil war. Both before and after the American Civil war, financing the Federal government was reliant on tariffs and duties. This changed in 1913 when the Federal Reserve Act passed.

Bankers and Wealthy Magnates continued to argue that tariffs were burdensome on American consumers, while consumer goods were only a very small portion of the average American's spending, so in reality, this affected only the wealthiest of Americans who could afford to purchase imported goods.

When the Federal Reserve Act was implemented in 1913, it was promised that only the most affluent would be affected, as was the case during the Civil War, and this would be to the benefit of less affluent Americans.

After WW1, War Revenue Act of 1917 was implemented, creating the system of taxation we are all familiar with today. No matter the income, everyone began to pay an income tax, both the poor and the wealthy alike.

After Democrats won unified control of Congress and the presidency in the 1912 elections, President Wilson, Congressman Carter Glass, and Senator Robert Latham Owen crafted a central banking bill that occupied a middle ground between the Aldrich Plan, which called for private control of the central banking system, and progressives like William Jennings Bryan, who favored government control over the central banking system. Wilson made the bill a top priority of his New Freedom domestic agenda, and he helped ensure that it passed both houses of Congress without major amendments. Later, President Wilson criticized the large centralization of credit and pointed out the direct harm to the development of the state. He wrote it in his book "Woodrow Wilson The New Freedom" on original page 111 or in pdf viewer page 116: "However it has come about, it Is more important still that the control of credit also has become dangerously centralized. It is the mere truth to say that the financial resources of the country are not at the command of those who do not submit to the direction and domination of small groups of capitalists who wish to keep the economic development of the country under their own eye and guidance. The great monopoly of this country is the monopoly of big credits. So long as that exists, our old variety and freedom and individual energy of development are out of the question. A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated."

https://en.wikipedia.org/wiki/Federal_Reserve_Act

Prior to the Civil War (1861–1865), America's revenue needs were met primarily through tariffs, duties, and other consumption taxes. In 1861, however, Congress adopted an income tax aimed at the nation's most affluent to finance the Civil War. The U.S. Supreme Court upheld the constitutionality of the income tax in Springer v. U.S. (1864). And in 1871, when the need for government revenue declined, Congress repealed the income tax, thereby placing the burden of financing government again almost entirely on tariffs and duties, increasing the cost of goods paid by workers. Thus, the repeal of the income tax shifted a portion of the tax burden away from the affluent to consumers generally.

The United States War Revenue Act of 1917 greatly increased federal income tax rates while simultaneously lowering exemptions.

The 2% bracket had previously applied to income below $20,000. That amount was lowered to $2,000. The top bracket (on income above $2 million) was raised from 15% to 67%.

The act was applicable to incomes for 1917.

-

1:44:50

1:44:50

Glenn Greenwald

5 hours agoTrump’s Latest Interviews Reveal A More Focused Vision; Why The CNN Syria Rescue Deserves Skepticism; Is There Anyone Who Opposes All Luigi-Style Vigilantism? | SYSTEM UPDATE #379

49.1K44 -

LIVE

LIVE

Flyover Conservatives

21 hours agoDOCTOR WARNS: The Invisible Threat to Your Health - Basima Williams | FOC Show

637 watching -

LIVE

LIVE

Precision Rifle Network

1 day agoS3E11 Guns & Grub with Rex & Joel

682 watching -

1:01:44

1:01:44

Donald Trump Jr.

7 hours agoThe MAGA Engine That Could: Interview with Steve Bannon | TRIGGERED Ep.198

119K109 -

1:48:08

1:48:08

Roseanne Barr

5 hours ago $1.76 earnedVibrator Burns with Shannon Hughey | The Roseanne Barr Podcast #78

52.6K32 -

58:33

58:33

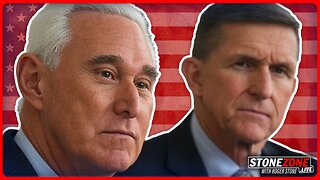

The StoneZONE with Roger Stone

8 hours agoWhat is Really Happening in Syria? w/ General Michael Flynn | The StoneZONE w/ Roger Stone

19.9K6 -

1:16:47

1:16:47

Josh Pate's College Football Show

6 hours ago $0.98 earnedSEC Bias: True Or False | Transfer Portal Latest | Belichick To UNC | Dan Mullen & Rich Rod Return

21.7K1 -

1:00:07

1:00:07

Havoc

5 hours agoTouring 101: The Best, The Worst & How to Survive Them | Stuck Off the Realness Ep. 22

16.8K -

LIVE

LIVE

Melonie Mac

1 day agoThe Game Awards Live Reaction! Go Boom Live Ep 31!

386 watching -

1:36:16

1:36:16

The Big Mig™

13 hours agoIs Paul Le Roux Satoshi Nakamoto w/ Evan Ratliff

29.4K7