Premium Only Content

Broken Promise on Interest Rates? Should Dr Lowe Go?

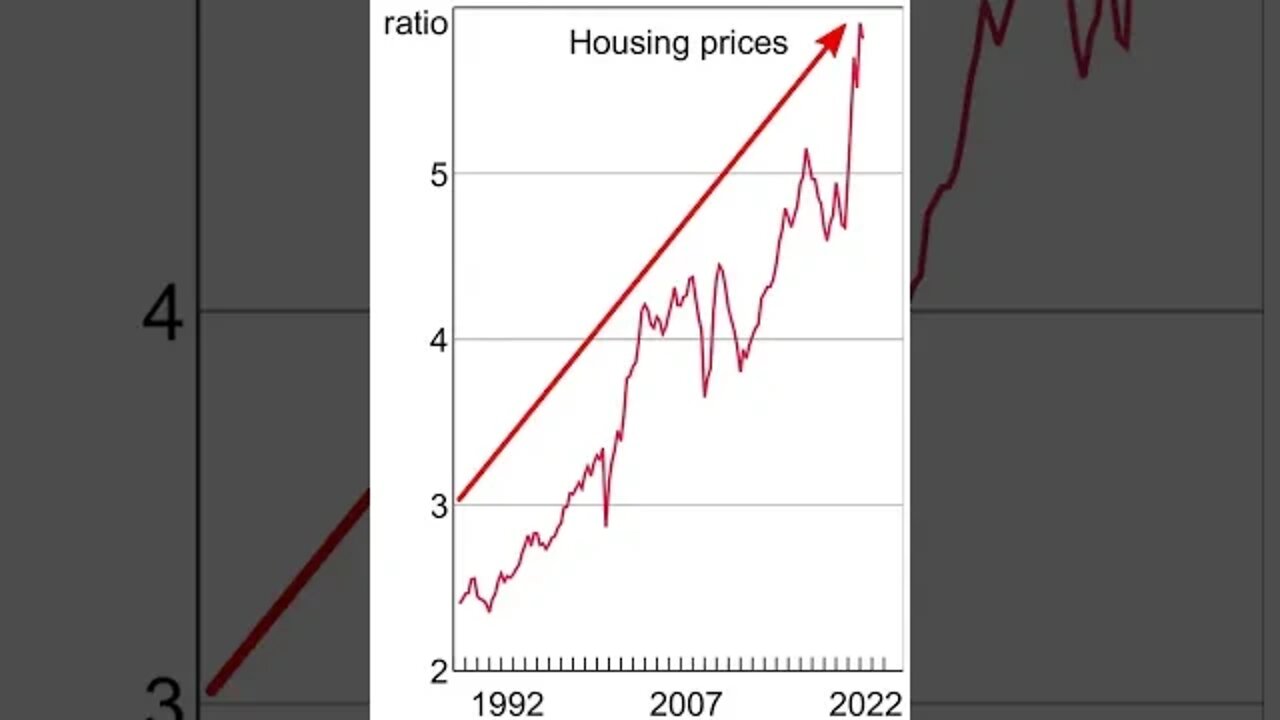

Over the last 30 years, interest rates have been drastically falling in Australia. As a result, house prices have been skyrocketing upwards. At the end of 2020, Reserve Bank Governor Philip Lowe reduced interest rates to a record low of 0.10%. In early 2021, Dr Lowe indicated that these record low rates would stay until at least 2024. Australians raced out and bought more houses fuelling the property boom creating one of the world’s most unaffordable markets. Household debt levels continued to rise. Then in May 2022, Dr Lowe broke his promise two years early and started raising interest rates. They have risen every month ever since costing young Australians hundreds of dollars per month in mortgage repayments, not to mention massive cost of living increases. Dr Lowe induced hundreds of thousands of Australians into taking out mortgages by saying that interest rates would not rise until 2024. He is now hurting them. Should Dr Lowe go?

#Shorts #interestrates #mortgagecrisis #mortgagerates #interestrate2022 #interestrates2022 #rbanews #rba

-

5:47

5:47

Daily Insight

3 months agoRebellious Musicians Not Allowed in Modern Australia

1071 -

55:05

55:05

The Dan Bongino Show

3 hours agoAmerica Is Back In The World Stage, And We Love To See It (Ep. 2433) - 02/28/2025

481K773 -

49:29

49:29

The Rubin Report

2 hours agoDetails About Joy Reid’s Weeping Farewell No One Noticed with Co-Host Megyn Kelly

30.1K17 -

LIVE

LIVE

Benny Johnson

2 hours ago🚨Epstein Files COVERUP EXPOSED: FBI Sabotaging Trump, DELETING Evidence?! | Tapes 'MISSING'?!

15,958 watching -

59:29

59:29

Steven Crowder

3 hours agoCrafting Crowder's Comedy Gold | Behind the Scenes

172K86 -

2:06:44

2:06:44

Tim Pool

2 hours agoTHE END OF THE WEST, Will We Survive Without Christianity? | The Culture War with Tim Pool

84.1K34 -

LIVE

LIVE

Right Side Broadcasting Network

3 hours agoLIVE: President Trump and Ukrainian President Zelenskyy Meet and Hold a Press Briefing - 2/28/25

5,879 watching -

LIVE

LIVE

LFA TV

16 hours agoBODYCAM FOOTAGE OF TRAFFIC STOP! | LIVE FROM AMERICA 2.28.25 11AM

4,570 watching -

LIVE

LIVE

The Big Mig™

4 hours agoGlobal Finance Forum From Bullion To Borders We Cover It All

2,069 watching -

31:13

31:13

Tudor Dixon

2 hours agoThe Last Supper with Chris Tomlin | The Tudor Dixon Podcast

95