Premium Only Content

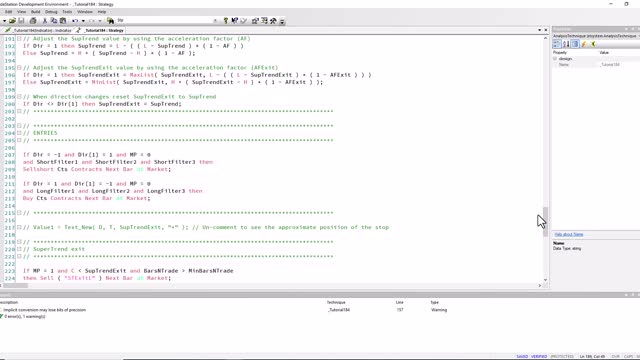

TradeStation EasyLanguge Tutorial 184 | SuperTrend strategy framework and indicator

Tutorial 184 is based on the Markplex SuperTrend indicator which is a stop and reverse (SAR) indicator that trails price action (See the original indicator here: https://markplex.com/free-tutorials/tutorial-173-markplex-supertrend/ )

This implementation calculates the Average True Range (ATR) of the average price using the exponential moving average. A user input multiple of the ATR is added to or subtracted from the average price to give Upper and Lwr respectively, depending on the direction. Direction is determined by the Close of a bar relative to the value of the SuperTrend, Upper and Lwr.

There are many different interpretations of the so-called SuperTrend indicator. In this Markplex version the SuperTrend value is also tightened (i.e. moved closer to price) by using an acceleration factor which increases incrementally each bar by user input: AFStep up to a a maximum value of user input: MaxAF.

In addition a 'Supertrend' stop is calulated (SupTrendExit). The value of this is set to the value of SupTrend when direction changes and is then calculated using:

SupTrendExit = MaxList( SupTrendExit, L - ( ( L - SupTrendExit ) * ( 1 - AFExit ) ) )

when Dir = 1, otherwise by:

SupTrendExit = MinList( SupTrendExit, H + ( SupTrendExit - H ) * ( 1 - AFExit ) )

A buy market order is generated when Dir changes from -1 to 1, provided that LongFilter1, LongFilter2 and LongFilter3 each evaluate to true and the program is not currently in a trade. A sell short market order is generated when Dir changes from 1 to -1, provide that ShortFilter1, ShortFilter2 and ShortFilter3 each evaluate to true and the program is not currently in a trade.

When in a long position and the close crosses under SupTrendExit a market order to exit the trade next bar is generated provided the trade has been in the trade more than the user input: MinBarsNTrade number of bars. Similarly, when in a short position and the close goes above SupTrendExit a market order to exit the trade next bar is generated provided the trade has been in the trade more than the user input: MinBarsNTrade number of bars. The user could experiment with replacing this functionality will other types of stop, for example a trailing stop.

The tutorial gives an example of LongFilter1 and ShortFilter1 using an implementation of the Moving Average Gap Ratio. If this is used, the user will need to change the strategies' "Maximum Number of Bars Study will reference" to be equal to the value of SlowLength. The user can experiment with replacing this filter with their own as the strategy tends to get 'whipsawed' in non-trending markets.

For more details go to: https://markplex.com/free-tutorials/tutorial-184-supertrend-strategy-framework-and-indicator/

-

27:28

27:28

Glenn Greenwald

13 hours agoGlenn Reacts to Trump's Gaza Take Over: System Update Special

186K426 -

2:13:49

2:13:49

Melonie Mac

10 hours agoGo Boom Live Ep 36!

100K9 -

1:02:11

1:02:11

Sarah Westall

10 hours agoFreezing USAID & its Operations in Ukraine: A Massive Money Laundering Organization? w/ Sam Anthony

90.2K20 -

2:05:35

2:05:35

Space Ice

14 hours agoSpace Ice & Redeye: Neil Breen's Pass Thru

39.2K1 -

1:00:23

1:00:23

The StoneZONE with Roger Stone

10 hours agoRoger Stone Talks Trump’s Electric First 100 Day Agenda | The StoneZone w/ Roger Stone

43.7K9 -

DVR

DVR

Redacted News

13 hours agoBREAKING! EPSTEIN LIST INCOMING UNDER AG PAM BONDI? DEMOCRATS FREAKING OUT, PRINCE ANDREW NERVOUS

194K306 -

52:02

52:02

Candace Show Podcast

15 hours agoBecoming Brigitte: An Inaccessible Past | Ep 2

179K270 -

2:07:26

2:07:26

2 MIKES LIVE

13 hours ago2 MIKES LIVE #176 News Breakdown Wednesday!

34.2K2 -

1:39:11

1:39:11

I_Came_With_Fire_Podcast

14 hours agoGAZA TAKEOVER | USAID EXPLAINED | TARIFF TAKEDOWN

52.2K10 -

37:14

37:14

The Based Mother

15 hours ago $1.67 earnedFULL OF IT! Crooked politicians say they care about children. Their actions tell a different story.

31.5K5