Premium Only Content

Credit Suisse Collapse Mean A Repeat Of 2008| Your Portfolio

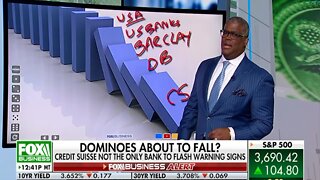

Credit Suisse Is In Deep Trouble. Contagion Risk Is Low??? Maybe? Maybe not- let's review.

Yet the market hasn’t been very comforted: The spread on Credit Suisse’s credit-default swaps, instruments that offer insurance against a company’s debt default, widened to its worst level since the Great Financial Crisis.

Everything old is new again. There are major problems at a big storied bank and “credit default swaps” are being watched closely once again against a backdrop of wider worries about a potential recession. Investors may be feeling a bit of déjà vu, but it’s not 2008—even if it will make for a tricky earnings season for U.S. banks.

American depositary receipts of Credit Suisse CSGN –4.15% Group (ticker: CS) got a small reprieve Monday amid the broader market rally, but are still bouncing along near their 52-week lows, following declines of its Swiss-traded shares (CSGN.Switzerland). The bank is grappling with the fallout of two big crises—the collapse of the U.S. hedge fund Archegos and the British financial firm Greensill—which combined cost it billions of dollars and led to a management shake-up.

The problems aren’t new: Nearly a year ago, Credit Suisse pledged to restructure following the blows—which themselves came months before a nearly half-billion dollar settlement stemming from an older scandal tied to loans it made in the African country of Mozambique.

The higher spread indicates that investors think the bet that Credit Suisse will endure is getting riskier. Year to date, Credit Suisse’s spread has widened ahead of other major European and U.S. banks, according to data from Refinitiv. Put another way, the cost of ensuring Credit Suisse’s riskier subordinated debt has shot up more than 27% from just over a week ago, as The Wall Street Journal noted.

Lehman Brothers’ collapse may be the analogy that springs to mind, but Credit Suisse’s size and importance make that scenario less likely, even the pessimists say. “Credit Suisse is NO Lehman, but it´s on par with Bear Stearns,” opines The Bear Traps founder Larry McDonald.

Nonetheless, with Europe mired in war and an energy crisis, and government bonds declining, a troubling picture for the bank is forming as the Continent teeters toward recession.

Credit Suisse’s market capitalization has fallen under 10 billion Swiss francs, which is a “worrying sign,” for a bank of its caliber, warns Keefe, Bruyette & Woods analyst Thomas Hallett. “We fear a negative feedback loop is now engulfing Credit Suisse, similar to Deutsche Bank DBK –1.69% in 2016 …replenishing the capital base, undergoing a large-scale cost reduction plan and a material shrinkage of the investment bank is the only way to stabilize investor perception and put the bank on a path to restore medium-term profitability.”

He estimates the company will need some 6 billion francs, two-thirds of which will have to come from a “highly dilutive capital raise,” meaning potentially further downside for the stock. Credit Suisse declined to comment.

The good news is that Credit Suisse’s woes don’t appear have the scale to create a domino effect that would topple U.S. banks, which have been posting quarterly profits during Credit Suisse’s recent losses. Nor were banks like Goldman Sachs GS –1.81% (GS) and Morgan Stanley (MS), which were also involved with Archegos, as negatively impacted.

Be Creative and kind!

Connect on:

Instagram: https://www.instagram.com/themcclonebrothers/

Twitter: https://twitter.com/themcclonebrot1

LinkedIn: https://www.linkedin.com/in/themcclonebrothers/

www.mbglobalestategroup.com

*MASTER YOUR MINDSET AND UNLOCK YOUR LIFE!

-

0:52

0:52

NONCONFORMING-CONFORMIST

9 months agoBuckle Up-Foreclosures

30 -

6:48

6:48

DonnahueGeorge

2 years agoWill Credit Suisse collapse cause AMC Squeeze?

1 -

18:24

18:24

johnsonwkchoi

2 years agoCredit Suisse & a repeat of 2008 Lehman-style world financial crisis fast approaching

46 -

11:17

11:17

xInfowarrior1776x

2 years agoCredit Suisse Faces “Lehman Moment,” Signaling Enormous Risk Of Global Collapse

13 -

4:34

4:34

Stocks With Cam

2 years agoCharles Payne: Credit Suisse Could Collapse the Whole Entire US Economy

45 -

1:00

1:00

CryptoWeeklyReview

2 years agoCredit Suisse is credit suss #shorts

7 -

14:13

14:13

The Money GPS

2 years ago $0.05 earnedCredit Suisse Collapse Would Be A Fraction of Total Losses | Much More Going On

161 -

4:42

4:42

DonnahueGeorge

2 years agoCredit Suisse is 2022 Lehman Bros

3 -

4:14

4:14

DonnahueGeorge

2 years agoCredit Suisse holding lots of AMC shorts

12 -

16:29

16:29

ETBP with Britt Gillette

2 years agoWill Credit Suisse Bring Down the EU?

164