Premium Only Content

Why are so many bond investors willing to accept lower returns on publicly owned company bonds?

Good question.

Most investors only invest in financial products their broker makes available to them in their online software. For that reason they only see the lower returns offered by public company bonds or perhaps government debt options.

Alamo Mortgage Holdings, Ltd a privately held United Kingdom company, offers corporate income bonds that offer higher rates of return than UK gilts.

Alamo Mortgage Holdings, Ltd a privately held United Kingdom company offers corporate income bonds that pay hundreds of basis points more than UK government gilts and most importantly can be US dollar denominated not Sterling bonds.

Another added advantage to Alamo Mortgage Holdings corporate income bonds is for investors that think the GBP is going to continue to weaken against the USD you can choose to be paid in GBP or USD.

Alamo Mortgage Holdings sells GBP denominated bonds and then purchases packages of US mortgage notes in the United States in the State of Texas.

The company receives payments in US dollars when purchasing packages of mortgage notes. As a result, we can offer higher returns to Uk institutional and accredited investors.

If you would like to learn more go to www.alamomortgageholdings.co.uk/ and fill out the contact form to request some free information to schedule a Zoom or Google Meet introductory call.

I wish you good luck with your investing!

Benjamin Z Miller, Managing Director

Alamo Mortgage Holdings, Ltd.

ben.miller@alamomortgageholdings.co.uk

www.alamomortgageholdings.co.uk/team.html

-

56:07

56:07

Dallas Trading Floor

2 years agoINTEREST RATES HIGHER BONDS LOWER

10 -

45:23

45:23

Op Freedom

2 years agoMajor corporations owned by a few investors & shareholders

7453 -

8:01

8:01

WFTS

2 years agoI-Team: 'Baalers' investors anticipated big returns that never materialized

1 -

2:13

2:13

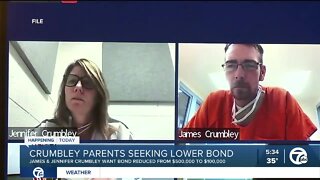

WXYZ

2 years agoCrumbley parents seeking lower bond

8 -

45:10

45:10

House Republicans

2 hours agoHouse Republican Leadership to Hold Press Conference Following Republican Election Victories

16.1K2 -

17:46

17:46

Dave Portnoy

2 hours agoDavey Day Trader Presented by Kraken - November 12, 2024

52.1K2 -

1:40:11

1:40:11

Graham Allen

4 hours agoTrump Trifecta Is OFFICIAL! Is Biden Stepping Down For Kamala? + Senate RINOs Must Be Dealt With!!

91K43 -

30:47

30:47

Matt Kohrs

3 hours agoLIVE! Rumble's Capital City Studios || The MK Show

38.6K4 -

38:46

38:46

BonginoReport

5 hours agoAmerica First is Under Attack (Ep.83) - 11/12/24

95.8K219 -

LIVE

LIVE

Vigilant News Network

15 hours agoVivek Sends Strong Post-Election Message to Democrats | The Daily Dose

1,542 watching