Premium Only Content

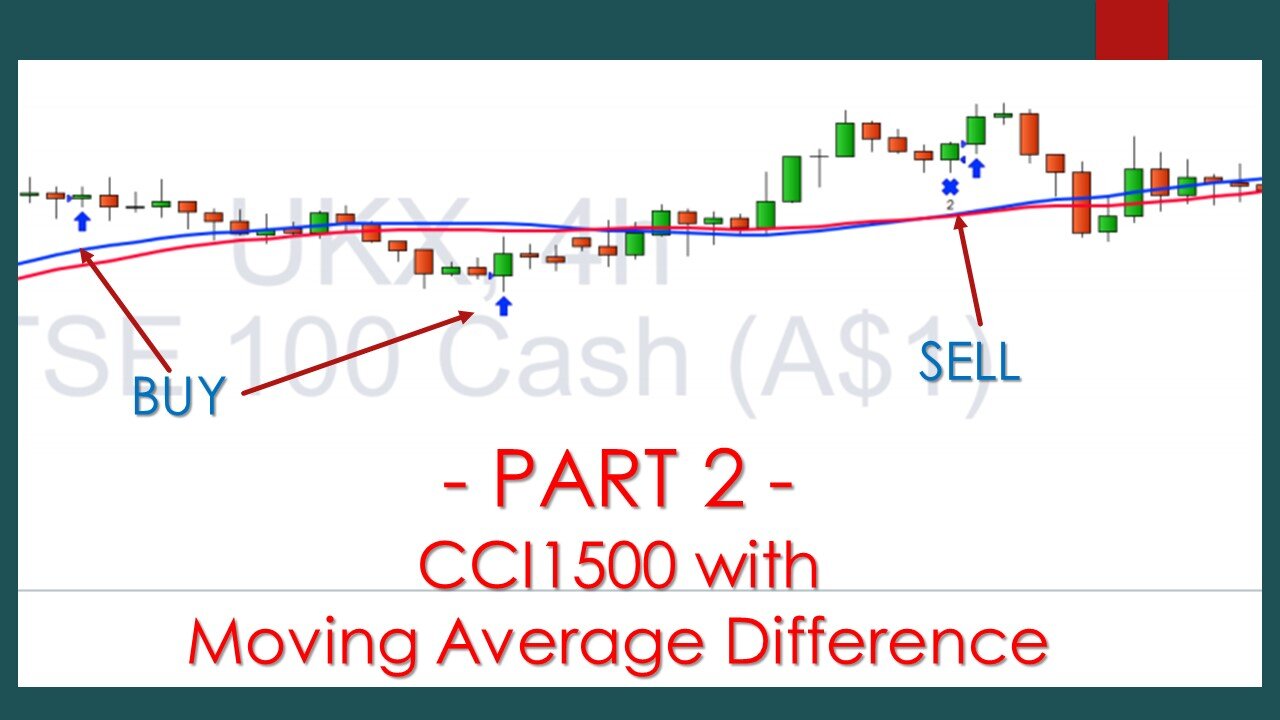

PART2 - CCI1500 and MA400 with Moving Average Difference.

PART2 - CCI1500 and MA400 with Moving Average Difference.

Welcome to Pete’s investing updates

in this strategy edition we will be talking about trading using the Commodity Channel Index Indicator with a simple moving average, and applying a % Gain and Average Down approach.

#bluechiptrading #sharetrading #ADX #averagedown #ExponentialMovingAverage #MovingAverage #CCI

Become a PetesInvesting Patreon member with same day updates on

https://www.patreon.com/petesinvesting

CCI350 Commodity Channel Index strategy

https://youtu.be/xEqQkeI4aUE

A Very Simple Moving Average (EMA9 MA20)

https://youtu.be/k9FStX2ke9g

Stochastic trading strategy quickie

https://youtu.be/RgFcN0zewjY

Don't forget...

First always remember to review petesinvesting channel playlists

Updated every weekend I look at the charts of some select blue chip shares as well as some key world sharemarket indices.

As always click on the SUBSCRIBE button as well as the NOTIFICATION bell and LIKE this video to support this channel.

If you want me to review an Index a share, a commodity or a FOREX pair, put it in the comments and I'll cover it in a future video

Things

to consider:

•We track and trade on a Daily chart since we want to back test and see results of trades back during the GFC as well as Covid effects.

•We track and back test Revenue over Drawdown requirements

(as a %) to optimize our returns with less exposure.

•Brokerage is included in our back testing. I use $8 per transaction each time we buy or sell. Revenue shown may change slightly depending on your brokerage costs.

•Our Back testing transacts with $2,000 per trade. ie everytime you purchase $2k worth of shares in the instrument you want to invest.

To increase Revenue (ie returns) simply increase this. But beware this will also increase your Drawdown, so ensure you factor in this with your money management strategy.

Lets get started

Remember...

Don't forget to subscribe / LIKE and hit the notification bell and review the PETESINVESTING channel playlists for further reference.

Using a Daily price chart, we review the weekly progress of a sample of Bluechip stocks from Australia, the US and Europe - Telefonica (TEF.BME), Commonwealth Bank Of Australia (CBA.AX), BHP Group Ltd Australia (BHP.AX), JPMorgan and Chase (JPM.NYSE), Volkswagen AG (VOW.XETRA), Johnson & Johnson (JNJ.NYSE), Caterpillar Inc (CAT.NYSE).

Showing any new open and closed positions, profitability and draw down requirements dependent on the trend of the respective price charts.

Supporting videos:

Alligator strategy explained:

https://youtu.be/1SMSRQV7GZE

Rumble updates

https://rumble.com/register/peteeight/

Bitchute updates:

https://www.bitchute.com/channel/pTjWs2A7K9Br/

Money Management:

https://youtu.be/nvvcldeeZS4

Average Down Do's and Don'ts

https://youtu.be/SZbh2Me4kq0

Simple Trading Strategy with CCI and Avg Down technique

https://youtu.be/w35_YtV4YQU

Simple trading strategy https://youtu.be/ibVzRwCX-3Q

Average Down Strategy https://youtu.be/RFCb5S78D8o

-

5:32

5:32

Petes Investing

5 days agoBITCOIN Divergence Retrace

461 -

54:38

54:38

LFA TV

1 day agoThe Resistance Is Gone | Trumpet Daily 12.26.24 7PM EST

75K12 -

58:14

58:14

theDaily302

22 hours agoThe Daily 302- Tim Ballard

71K13 -

13:22

13:22

Stephen Gardner

16 hours ago🔥You'll NEVER Believe what Trump wants NOW!!

119K346 -

54:56

54:56

Digital Social Hour

1 day ago $12.53 earnedDOGE, Deep State, Drones & Charlie Kirk | Donald Trump Jr.

67.9K6 -

DVR

DVR

The Trish Regan Show

17 hours agoTrump‘s FCC Targets Disney CEO Bob Iger Over ABC News Alleged Misconduct

71.6K43 -

1:48:19

1:48:19

The Quartering

18 hours agoElon Calls White People Dumb, Vivek Calls American's Lazy & Why Modern Christmas Movies Suck!

151K114 -

2:08:42

2:08:42

The Dilley Show

19 hours ago $37.76 earnedH1B Visa Debate, Culture and More! w/Author Brenden Dilley 12/26/2024

129K44 -

4:55:59

4:55:59

LumpyPotatoX2

21 hours agoThirsty Thursday on BOX Day - #RumbleGaming

116K9 -

1:04:52

1:04:52

Geeks + Gamers

20 hours agoDisney RATIO'D on Christmas Day | Mufasa Embarrassed By Sonic 3

85.1K13