Premium Only Content

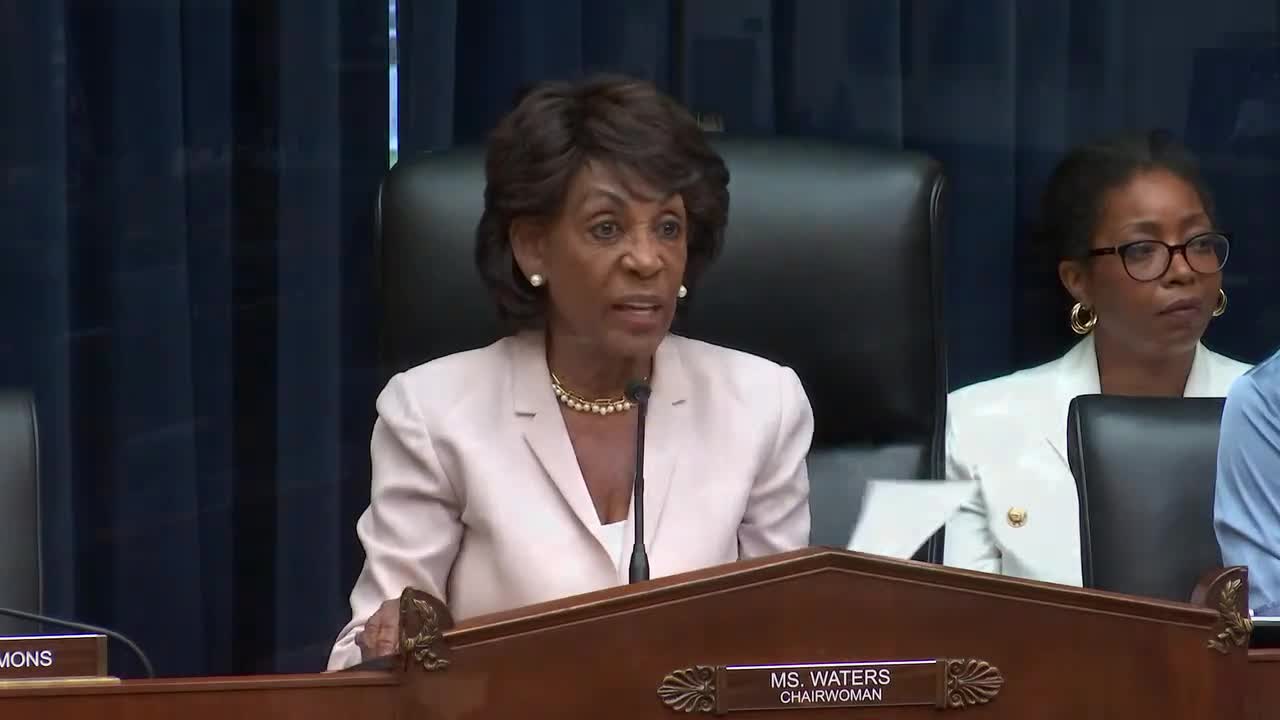

U.S. House Committee on Financial Services: Holding Megabanks Accountable: Oversight of America’s Largest Consumer Facing...

On Wednesday, September 21, 2022, at 10:00 a.m. (ET) full Committee Chairwoman Waters and Ranking Member McHenry will host a virtual hearing entitled, “Holding Megabanks Accountable: Oversight of America’s Largest Consumer Facing Banks."

Witness for this one-panel hearing will be:

• Andy Cecere, Chairman, President, and CEO, U.S. Bancorp

• William Demchak, Chairman, President, and CEO, The PNC Financial Services Group

• Jamie Dimon, Chairman and CEO, JPMorgan Chase & Co.

• Jane Fraser, CEO, Citigroup

• Brian Moynihan, Chairman and CEO, Bank of America

• William Rogers Jr., Chairman and CEO, Truist Financial Corporation

• Charles Scharf, President and CEO, Wells Fargo & Company

Background

This hearing is the continuation of a series of hearings with the Chief Executive Officers of the largest U.S. banks to review trends and developments in the industry in recent years. Representing the largest U.S. commercial banks, the CEOs of Bank of America (BofA), Citigroup (Citi), JPMorgan Chase (JPM), PNC, Truist, U.S. Bancorp (U.S. Bank), and Wells Fargo have been asked to testify on various issues, including consumer protection and compliance issues, enforcement actions and recidivism; diversity, inclusion, and racial equity; mergers and acquisitions; emerging technologies; and issues relating to the public interest, including worker rights and abortion access, among other topics. America’s largest commercial banks play a critical role in the everyday lives of consumers and the overall health of our economy. As Congress looks to tackle major issues such as pervasive racial inequalities in financial services, systemic risks to our financial system, including climate change, as well as the ongoing COVID19 pandemic, and Russia’s invasion of Ukraine, this hearing will bring greater transparency and accountability for the actions of these major industry players.

Recent Growth, Branches, and Enforcement Actions

BofA, Citi, JPM, PNC, Truist, U.S. Bank, and Wells Fargo are the seven largest commercial banks in the United States. These banks have maintained adequate capital and leverage ratios, provided PPP loans, and engaged in stock buybacks in 2021. With the exception of Wells Fargo, which is subject to an asset cap restriction imposed by the Fed, these banks have generally increased in size since 2019 and collectively hold more than $11 trillion in assets. Recent mergers have played a role in the growth and number of megabanks. For example, PNC was approved to acquire BBVA in May 2021 and is now the sixth largest U.S. depository, while prior to the acquisition, PNC was the 12th largest. Truist was the result of a merger between two regional banks, BB&T and SunTrust, that was approved in 2019, and the bank is now the seventh largest commercial bank. U.S. Bank, the fifth largest commercial bank, applied to acquire MUFG Union Bank in October 2021, and the application is still pending.6 Meanwhile, the other banks have each merged with, or acquired, other businesses since 2020.

Banking deserts, where communities lack adequate access to a nearby bank branch, may make it more difficult to reduce the number of Americans who are unbanked and underbanked. Since 2010, the four largest banks have closed 4,727 (25%) of their branches. A recent study showed the pace of branch closures doubled during the pandemic and one-third of bank branches closed from 2017 to 2021 were in low- to moderate-income (LMI) communities and communities of color.

The largest banks continue to face enforcement actions for unlawful behavior, often to the detriment of consumers. In recent years, the Committee has reviewed a long list of enforcement actions taken against megabanks over the previous decade—most notably the multiple open consent orders on Wells Fargo stemming from their compliance failures and egregious consumer abuse—while the banks made record profits over the same period. Since their testimony last year, certain banks have faced additional enforcement actions and regulatory sanctions. For example, BofA was fined $225 million for wrongfully freezing accounts and preventing the disbursement of state unemployment benefits at the height of the pandemic. Wells Fargo was assessed a $250 million penalty from the OCC for deficiencies in its home lending loss mitigation program, as well as violating a 2018 consent order. U.S. Bank also faced a $37.5 million fine earlier this year for illegally opening fake accounts.

Consumer Protection

Mortgage Lending. Rising interest rates in response to inflation are cooling demand for mortgage originations for most banks...

-

15:17

15:17

R.C. Davis

1 day ago‘THIS IS NOT THEATER’: Scott Bessent encourages countries to take Trump at his word

143 -

2:00:47

2:00:47

PaddysParlorGames

14 hours agoSunday Parlor Chill: GOBSTEIN

27.3K2 -

LIVE

LIVE

Major League Fishing

4 days agoLIVE! - Bass Pro Tour: Stage 2 - Day 4

951 watching -

56:24

56:24

Russell Brand

1 day agoEddie Gallagher: War, Betrayal & Fighting the System

97.4K11 -

11:21

11:21

TimcastIRL

6 hours agoGOP Rep Says TWO SHOOTERS In JFK Assassination As FBI Uncovers TROVE Of Secret Documents

106K145 -

1:04:55

1:04:55

Bare Knuckle Fighting Championship

4 days agoBKFC ITALY PRESS CONFERENCE | LIVE!

54.8K5 -

10:04

10:04

Space Ice

4 hours agoThe Movie Silent Hill Is Like Resident Evil Without The Good Parts - Worst Movie Ever

31.3K10 -

5:49

5:49

Hannah Barron

1 day agoRedneck Euro Mount

26.1K20 -

32:34

32:34

hickok45

9 hours agoSunday Shoot-a-Round # 268

20.2K12 -

27:33

27:33

The Finance Hub

19 hours ago $13.47 earnedBREAKING: ALINA HABBA JUST DROPPED A MASSIVE BOMBSHELL!!!

57.8K100