Premium Only Content

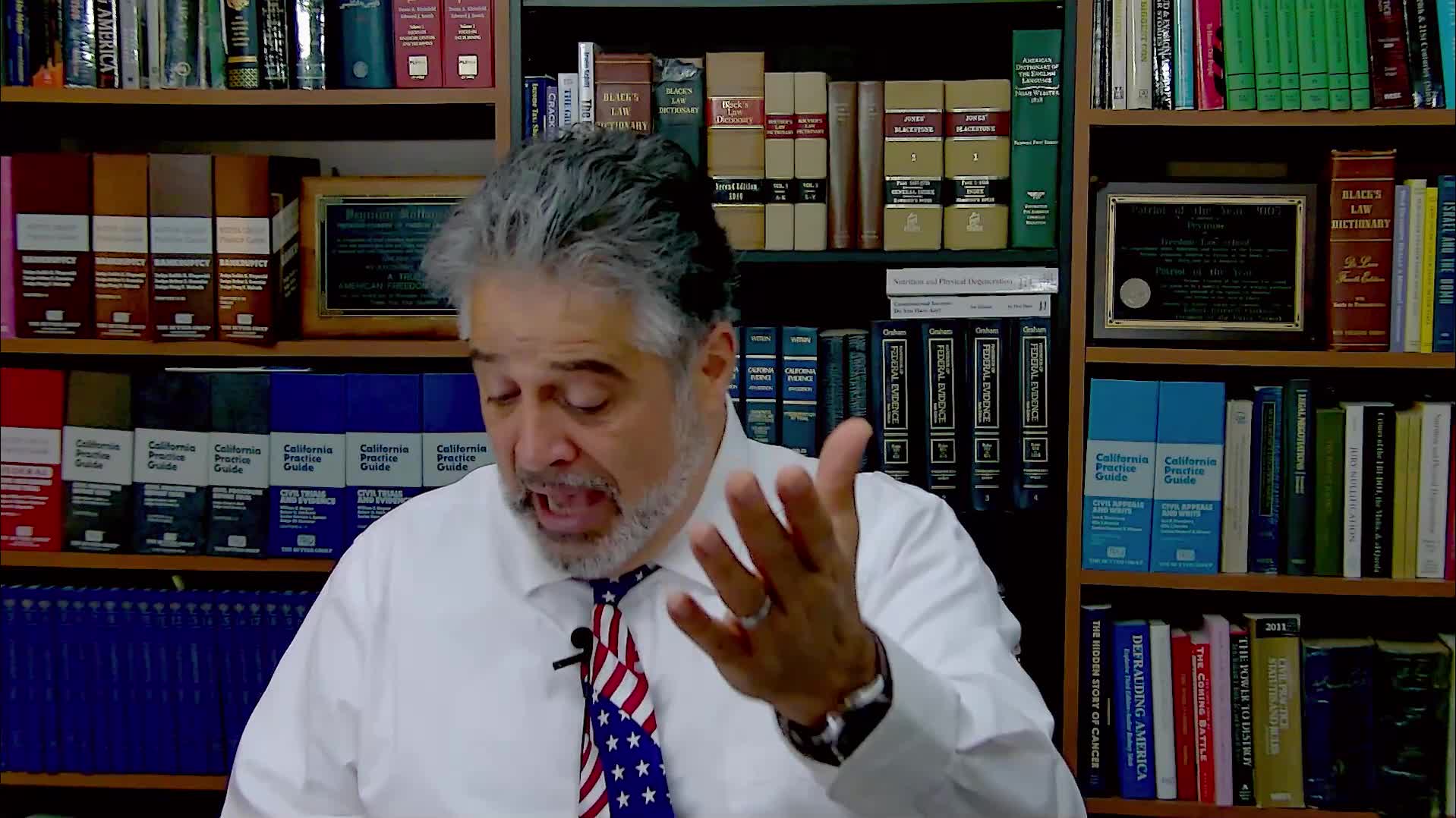

Are you really “SELF-EMPLOYED”? If so, do you owe income taxes according to US law?

"Most Americans are under the impression that if they are not an employee who has 7.65% of their wages deducted for FICA (payroll) tax (Social Security and Medicare taxes), that they need to pay 15.3% of their net income for self-employment income tax. This tax is a tremendous burden on independent contractors and small business owners, since no one deducts and withholds that money from their earnings and a whole year’s worth of these taxes becomes due every April 15th.

In this Freedom Hour presentation, Peymon Mottahedeh, founder and President of Freedom Law School, will show you how the law defines “self-employment income” and consequently, who owes an income tax on that income and who does NOT owe self-employment income tax.

You may be one of those Americans who does NOT owe self-employment income tax. Listen and find out!"

-

10:22

10:22

Dr Disrespect

2 days agoDR DISRESPECT - 2024 RECAP

20.6K73 -

LIVE

LIVE

The Charlie Kirk Show

1 hour agoThe 2025 Speaker Election + DEI FBI + Britain's Grooming Gangs | Gaetz, Gilliam, Marshall | 1.3.2025

11,421 watching -

Grant Stinchfield

3 hours agoThe Left's Will Evil Plot to Prevent Trump from Taking Office Exposed!

3.43K6 -

52:32

52:32

The Dan Bongino Show

3 hours agoProducer's Picks: Bongino's Best Segments - 01/03/25

95.4K309 -

56:49

56:49

VSiNLive

3 hours agoA Numbers Game with Gill Alexander | Hour 1

22.1K1 -

LIVE

LIVE

Film Threat

16 hours ago2025 MOVIES TO LOOK FORWARD TO + JANUARY'S BEST FILMS | Film Threat Livecast

351 watching -

LIVE

LIVE

The Shannon Joy Show

3 hours ago🔥🔥Friday Freestyle LIVE With Shannon Joy! Ask Me Anything On The Open Live Chat!🔥🔥

377 watching -

1:05:01

1:05:01

The Big Mig™

17 hours agoGlobal Finance Forum Powered By Genesis Gold Group

5.42K4 -

1:31:22

1:31:22

Caleb Hammer

3 hours agoEgo-Maniac Thinks She Can Manifest Problems Away | Financial Audit

20.9K1 -

2:02:38

2:02:38

LFA TV

6 hours agoSPEAKER VOTE LIVE! | LIVE FROM AMERICA 1.3.25

33.5K26