Premium Only Content

I got an IRS Form W-2 – Does this mean I must file a 1040 tax form and pay US income taxes?

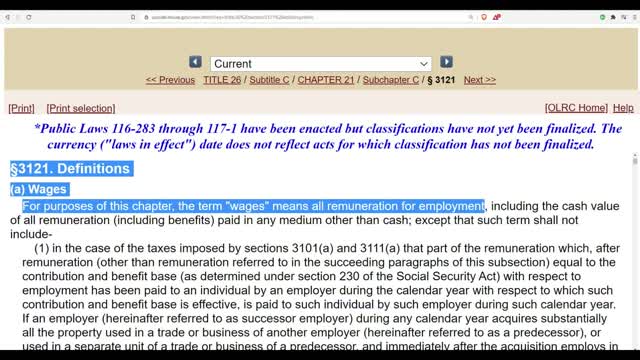

"Every January most employers across America send W-2 forms to the IRS showing the wages earned, amounts deducted and withheld as pre-payment for individual income taxes according to the W-4 form provided by the employee, and the amounts paid for Social Security and Medicare taxes. State and local income taxes withheld are also shown on the W-2 form. A copy of the W-2 form is provided to the employee who received the wage payments.

You may have received an IRS Form W-2 yourself and are wondering whether you will be breaking the law and risking fines, penalties and even imprisonment if you do not report those payments as taxable income on a Form 1040 by April 15th.

In this full presentation on this topic, Peymon Mottahedeh, founder and president of Freedom Law School, explains the laws about W-2 forms:

• What to do if you received a copy; and

• How to STOP:

- withholding of individual income taxes from your pay;

- Stop your employer from erroneously reporting your payments to the IRS on W-2 forms in the future; as well as

- Stop your employer from unlawfully deducting Social Security and Medicare taxes from your pay."

-

1:15:15

1:15:15

Dr. Drew

7 hours agoLuke Rudkowski: Epstein List Release Fail, Zelenskyy's White House Tantrum & Corruption In Congress – Ask Dr. Drew

36.5K12 -

1:05:46

1:05:46

Candace Show Podcast

7 hours agoHarvey Speaks: Shocking Emails Revealed | Ep 2

77.1K46 -

1:51:18

1:51:18

Michael Franzese

4 hours agoRFK Was Right… But It’s Worse Than You Think | Jillian Michaels

43K22 -

1:23:47

1:23:47

Redacted News

4 hours agoEPSTEIN BOMBSHELL! SOMETHING VERY STRANGE IS GOING ON HERE, WHO ARE THEY PROTECTING? | REDACTED LIVE

122K189 -

1:05:37

1:05:37

Sean Unpaved

6 hours ago $3.80 earnedUnpaved

58.4K8 -

56:40

56:40

VSiNLive

4 hours ago $2.82 earnedFollow the Money with Mitch Moss & Pauly Howard | Hour 1

51.8K4 -

1:00:52

1:00:52

In The Litter Box w/ Jewels & Catturd

1 day agoFIRST 40 DAYS | In the Litter Box w/ Jewels & Catturd – Ep. 754 – 3/4/2025

99.6K46 -

1:20:04

1:20:04

Awaken With JP

8 hours agoHow Impressive is Zelensky? - LIES Ep 81

105K48 -

2:14:02

2:14:02

The Quartering

8 hours agoEpstein Files FINALLY Arrive, Zelensky CRAWLS Back & Trump Cuts Off, Oscars Sink To New Low & More

126K49 -

57:11

57:11

Russell Brand

7 hours agoBREAK BREAD EP. 16 - SEAN FEUCHT

116K6