Premium Only Content

Feds found Pfizer too big to nail | CNN (2010)

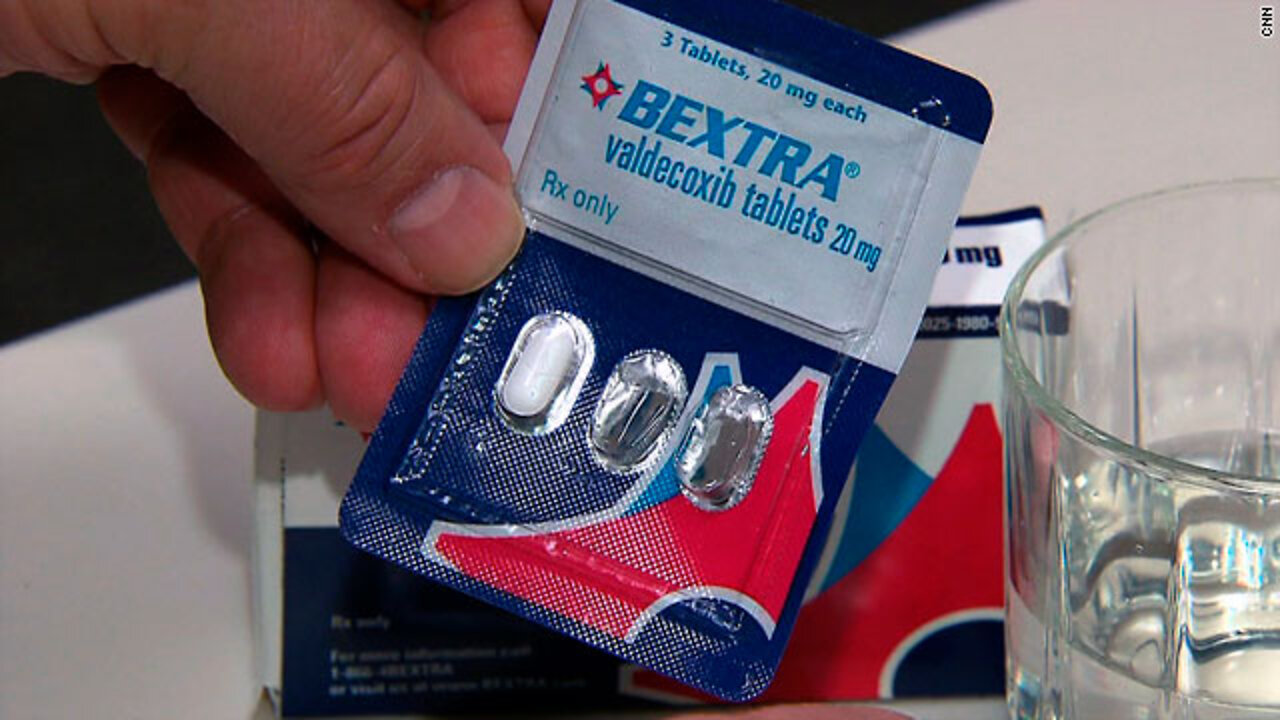

While it's legal for doctors to PRESCRIBE approved drugs off-label, i.e. for a different diagnosis then the drug was originally approved for, off-label PROMOTION by pharmaceutical companies is illegal. With billions at stake, this is exactly what Pfizer did with its drug Bextra.

It was known that Bextra was dangerous to people with an increased risk of heart attacks or strokes, but Pfizer promoted the drug anyway.

The people involved knew they would personally not be criminally indicted. They might be fired, but they knew they would be fired anyway if the drug did not meet minimum sales targets.

The text below has been copy pasted from this article:

https://edition.cnn.com/2010/HEALTH/04/02/pfizer.bextra/index.html

By April 2005, when Bextra was taken off the market, more than half of its $1.7 billion in profits had come from prescriptions written for uses the FDA had rejected.

TOO BIG TO NAIL

But when it came to prosecuting Pfizer for its fraudulent marketing, the pharmaceutical giant had a trump card: Just as the giant banks on Wall Street were deemed too big to fail, Pfizer was considered too big to nail.

Why? Because any company convicted of a major health care fraud is automatically excluded from Medicare and Medicaid. Convicting Pfizer on Bextra would prevent the company from billing federal health programs for any of its products. It would be a corporate death sentence.

Prosecutors said that excluding Pfizer would most likely lead to Pfizer's collapse, with collateral consequences: disrupting the flow of Pfizer products to Medicare and Medicaid recipients, causing the loss of jobs including those of Pfizer employees who were not involved in the fraud, and causing significant losses for Pfizer shareholders.

"We have to ask whether by excluding the company [from Medicare and Medicaid], are we harming our patients," said Lewis Morris of the Department of Health and Human Services.

So Pfizer and the feds cut a deal. Instead of charging Pfizer with a crime, prosecutors would charge a Pfizer subsidiary, Pharmacia & Upjohn Co. Inc.

The CNN Special Investigation found that the subsidiary is nothing more than a shell company whose only function is to plead guilty.

According to court documents, Pfizer Inc. owns (a) Pharmacia Corp., which owns (b) Pharmacia & Upjohn LLC, which owns (c) Pharmacia & Upjohn Co. LLC, which in turn owns (d) Pharmacia & Upjohn Co. Inc. It is the great-great-grandson of the parent company.

Public records show that the subsidiary was incorporated in Delaware on March 27, 2007, the same day Pfizer lawyers and federal prosecutors agreed that the company would plead guilty in a kickback case against a company Pfizer had acquired a few years earlier.

As a result, Pharmacia & Upjohn Co. Inc., the subsidiary, was excluded from Medicare without ever having sold so much as a single pill. And Pfizer was free to sell its products to federally funded health programs.

AN IMAGINARY FRIEND

Two years later, with Bextra, the shell company once again pleaded guilty. It was, in effect, Pfizer's imaginary friend stepping up to take the rap.

"It is true that if a company is created to take a criminal plea, but it's just a shell, the impact of an exclusion is minimal or nonexistent," Morris said.

Prosecutors say there was no viable alternative.

"If we prosecute Pfizer, they get excluded," said Mike Loucks, the federal prosecutor who oversaw the investigation. "A lot of the people who work for the company who haven't engaged in criminal activity would get hurt."

Did the punishment fit the crime? Pfizer says yes.

It paid nearly $1.2 billion in a criminal fine for Bextra, the largest fine the federal government has ever collected.

It paid a billion dollars more to settle a batch of civil suits -- although it denied wrongdoing -- on allegations that it illegally promoted 12 other drugs.

In all, Pfizer lost the equivalent of three months' profit.

It maintained its ability to do business with the federal government.

Pfizer says it takes responsibility for the illegal promotion of Bextra. "I can tell you, unequivocally, that Pfizer perceived the Bextra matter as an incredibly serious one," said Doug Lankler, Pfizer's chief compliance officer.

To prevent it from happening again, Pfizer has set up what it calls "leading-edge" systems to spot signs of illegal promotion by closely monitoring sales reps and tracking prescription sales.

It's not entirely voluntary. Pfizer had to sign a corporate integrity agreement with the Department of Health and Human Services. For the next five years, it requires Pfizer to disclose future payments to doctors and top executives to sign off personally that the company is obeying the law.

Pfizer says the company has learned its lesson.

But after years of overseeing similar cases against other major drug companies, even Loucks, isn't sure $2 billion in penalties is a deterrent when the profits from illegal promotion can be so large.

"I worry that the money is so great," he said, that dealing with the Department of Justice may be "just of a cost of doing business."

SOURCE: https://t.me/DowdEdward/765

-

LIVE

LIVE

a12cat34dog

10 hours agoGETTING AFTERMATH COMPLETED :: Call of Duty: Black Ops 6 :: ZOMBIES CAMO GRIND w/Bubba {18+}

239 watching -

8:23:18

8:23:18

NubesALot

13 hours ago $5.44 earnedDark Souls Remastered and party games

32.7K -

3:03:42

3:03:42

GamersErr0r

1 day ago $2.25 earnedits not what you think

26.5K1 -

7:15:50

7:15:50

Phyxicx

11 hours agoRocket League with Friends! - 11/22/2024

20.1K1 -

7:54:29

7:54:29

STARM1X16

11 hours agoFriday Night Fortnite

16.7K -

29:51

29:51

Afshin Rattansi's Going Underground

1 day agoJimmy Dore on Ukraine & WW3: Biden Wants a War that Trump CAN’T Stop, ONLY Hope is Putin’s Restraint

74.6K32 -

3:20:54

3:20:54

Fresh and Fit

13 hours agoExposing WHO Killed JFK w/ Cory Hughes & Tommy Sotomayor

95.9K61 -

2:41:29

2:41:29

RanchGirlPlays

13 hours ago🔴 Red Dead Redemption: Let's go help De Santa 🤠

7.63K3 -

1:39:58

1:39:58

Man in America

19 hours agoWHAT?! Trump & the Fed are DISMANTLING the Global Banking Cartel!? w/ Tom Luongo

38.4K48 -

2:00:29

2:00:29

HELMET FIRE

9 hours agoDEADROP IS BACK!

6.85K2