Premium Only Content

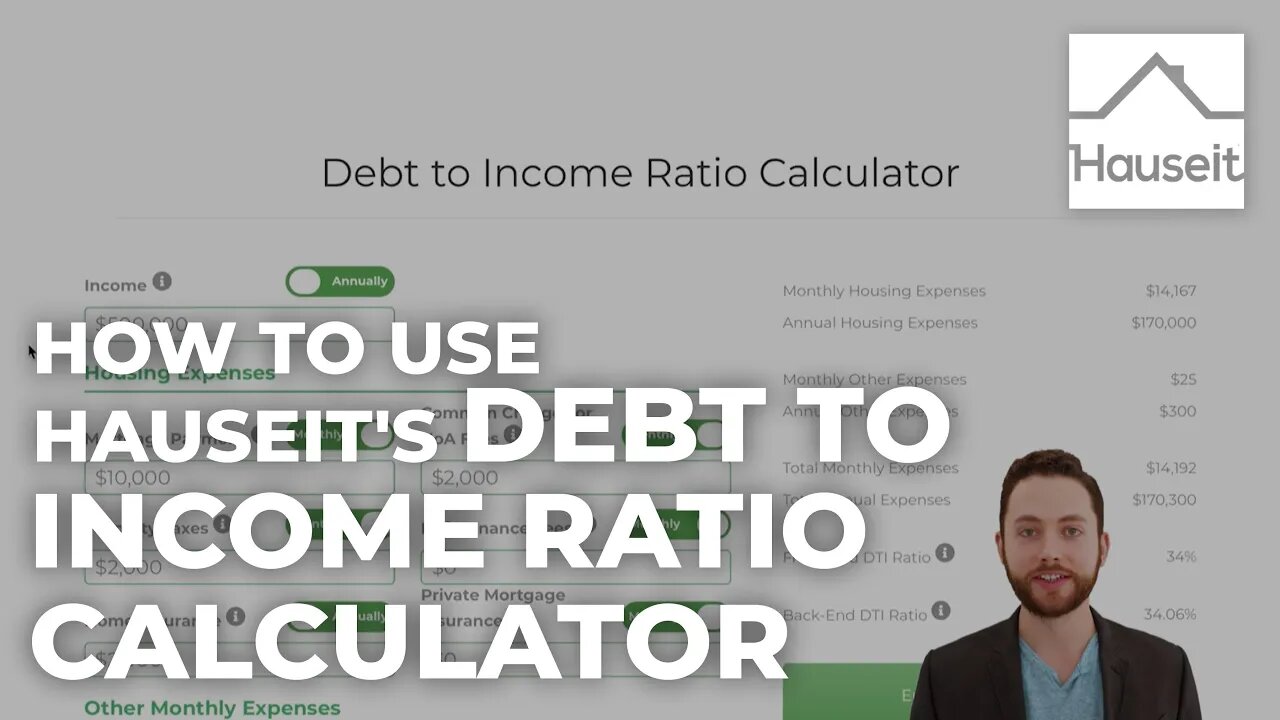

How to Use Hauseit's Debt to Income Ratio Calculator

Debt-to-Income Ratio Calculator: https://www.hauseit.com/debt-to-income-ratio-calculator/

Save 2% When Buying in NYC: https://www.hauseit.com/hauseit-buyer-closing-credit-nyc/

In today's video we will show you how to use the Hauseit Debt-to-Income Ratio Calculator. Now the calculator helps you figure out both your front-end and back-end debt to income ratios, and those ratios are very important when you think about full affordability for your mortgage, for example, or if you're buying a co-op in New York City, how much you can afford and comply with any co-op requirements on debt to income ratio.

So, if you're not already on the calculator there's two ways to get here, the first way is to visit our website https://www.hauseit.com/debt-to-income-ratio-calculator/, spelling is up here. Go to resources, scroll down to calculators and the debt to income ratio calculator is right there.

So, the calculator allows us to figure out two different things. One is the front-end debt to income ratio and the other is the back-end debt to income ratio. So, perhaps we can go over that very quickly. If you scroll down to our glossary and FAQ section, we have the definitions right here. So, the front-end debt to income ratio is the percentage of pre-tax gross monthly income which covers housing expenses. Now this includes your mortgage payment, property taxes, if you own a condo it would include your common charges, if you own a co-op it would be your monthly maintenance payment to the building. This would also include homeowner’s insurance.

Now the front-end debt to income ratio only includes housing related expenses. So, if you owned a Porsche or if you had a Toyota Camry or whatever it might be and you had at least payment for that the front-end debt to income ratio does not factor in that monthly liability that you have to pay for your car or for student loans or if you have and maintain credit card balances. Now the back-end debt to income ratio is everything the front-end ratio is but we also add in those other liabilities that we just mentioned student loan payments, car payments, anything that you have to constantly pay every month that will also appear on your credit report.

So, if we go up to the calculator here you could actually input all of the required items to figure out your front and back-end DTI. The most important item is your income and keep in mind as we've mentioned this is your total pre-tax income. It should include everything that would be on a tax return wages, dividend income, rental income and stipends. Now two ways to do it if you prefer to think about your income as an annual figure you can put that in directly or if you think more about things on a monthly basis you can toggle between annual and monthly as far as your income is concerned.

Now here in housing expenses you have that same option you can think about everything in an annual basis or on a monthly basis and the things we need to know would be your mortgage payment, your common charges in case of a condo, we need to know your property taxes if you own a condo or a house, keep in mind a co-op there would not be anything in this field. And if you own a co-op you would fill in the maintenance fees and remember that a co-op pays property taxes directly on behalf of unit owners. So, if you own a condo you have two things to pay every month. You have to pay your common charges and you have to pay property taxes. With a co-op you just pay your co-op maintenance, of course, in neither case you would also pay your mortgage if you are financing.

The other things that are included in front-end DTI are your homeowner’s insurance payment as well as any private mortgage insurance that you may have. Other expenses would include but are not limited to student loan payments, credit card payments, car lease or other loan payments, as well as any other mandatory payments you're on the hook for. For the purposes of this example, let's go ahead and put in $500 for a car loan payment. Now, as we can see on the top right, we have two calculations we have the front-end DTI and back-end DTI. The back-end debt to income ratio is always going to be slightly higher, assuming that you have other non-housing related liabilities that you have to pay on a monthly basis.

Save 2% When Buying in NYC: https://www.hauseit.com/hauseit-buyer-closing-credit-nyc/

NYC Buyer Closing Cost Calculator: https://www.hauseit.com/closing-cost-calculator-for-buyer-nyc/

.

.

Hauseit LLC, Licensed Real Estate Broker

Tel: (888) 494-8258 | https://www.hauseit.com

_

#hauseit #hauseitnyc

-

12:15

12:15

Fatal Investing

2 years agoHow to Maximize Dividend Income | Calculator Update

21 -

9:16

9:16

The Ramsey Show Highlights

2 years agoHow Do I Pay Off Debt On A Single Income?

2412 -

1:38

1:38

bikejar

2 years agoHow to Use BikeJar Bike Sizing Calculator

3 -

9:25

9:25

The Ramsey Show Highlights

2 years agoHow Do We Tackle Debt After Losing Half Of Our Income?

2472 -

0:27

0:27

Pixolini

2 years agoReal Estate Investment Calculations - Debt Coverage Ratio

7 -

3:07

3:07

Get Your Money Right

3 years agoHow Do I Pay Off Big Debt With Little Income

17 -

1:11:07

1:11:07

PMG

1 day ago $17.86 earned"Alarming Parallels of Modern America and the Roman Empire | Jeremy Ryan Slate"

100K53 -

46:39

46:39

Stephen Gardner

20 hours ago🔥FINALLY! Trump BLACKMAIL scheme EXPOSED | 'Ukraine will be DESTROYED' worries US Pentagon!

148K247 -

![Devin Nunes - Truth Social Gets An Upgrade, We Will Celebrate The Destruction Of The [DS] With Wine](https://1a-1791.com/video/s8/1/0/G/j/J/0GjJv.0kob-small-Devin-Nunes-Truth-Social-Ge.jpg) 50:15

50:15

X22 Report

21 hours agoDevin Nunes - Truth Social Gets An Upgrade, We Will Celebrate The Destruction Of The [DS] With Wine

290K307 -

1:40:54

1:40:54

Michael Franzese

1 day agoBiden's not done destroying America & what happened in New Jersey?

120K148