Premium Only Content

Empower Retirement - Learning center - Investing 101 - An Overview

https://rebrand.ly/Goldco4

Get More Info Now

Empower Retirement - Learning center - Investing 101 - An Overview, retirement investing basics

Goldco helps clients safeguard their retired life cost savings by rolling over their existing IRA, 401(k), 403(b) or other professional pension to a Gold IRA. ... To discover exactly how safe haven rare-earth elements can assist you construct and secure your wealth, and also even secure your retired life telephone call today retirement investing basics.

Goldco is among the premier Precious Metals IRA firms in the United States. Shield your wealth and also resources with physical precious metals like gold ...retirement investing basics.

In preparing for retirement, you determine your objectives and after that find out how to conserve and invest to arrive. A lot of retirement investing advice focuses on extremely specific formulas and techniques. Still, in some cases it's practical to take a step back and look at the huge photo. Here are six basic pointers to assist make retirement investing a little easier.

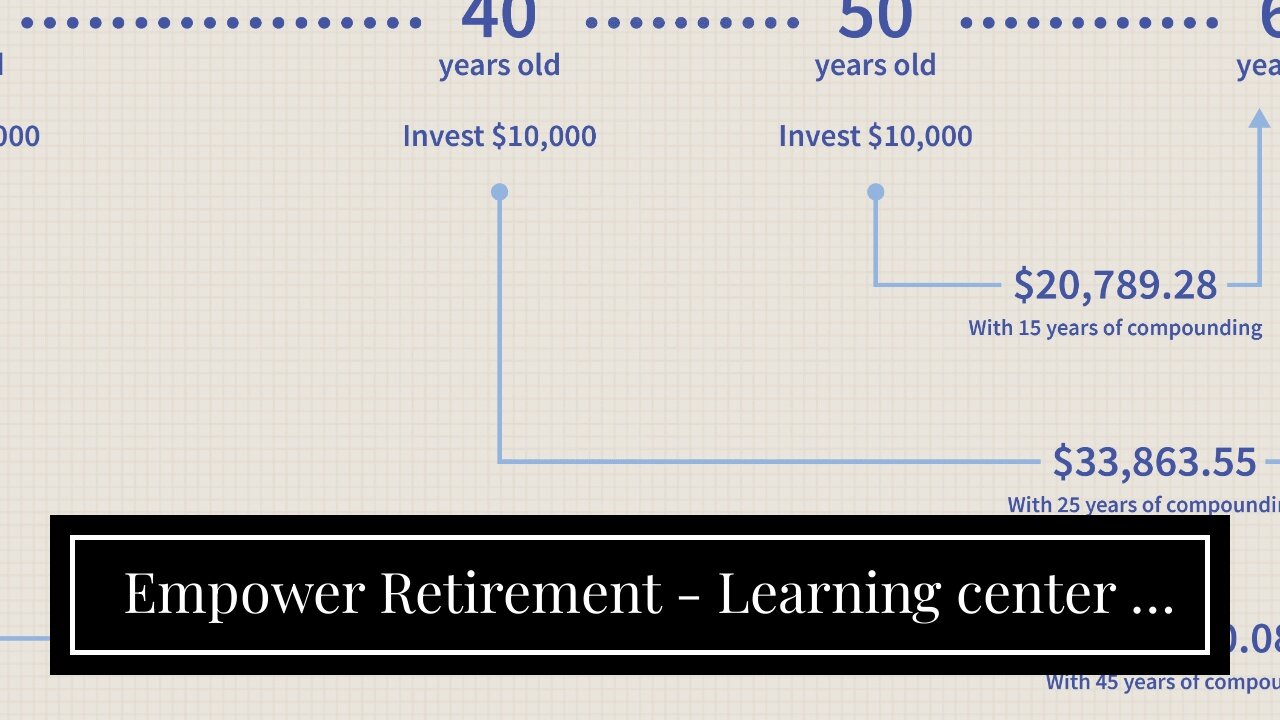

Start saving for retirement early, so your cash has more time to grow. Calculate your net worth on a routine basis to see if you're on track for retirement. Take note of financial investment costs because they can considerably erode your retirement funds. Work with a monetary expert if you require aid or guidance.

Understand Your Retirement Investment Options You can conserve for retirement in different tax-advantaged and taxable accounts. Some are used by your company, while others are available through a brokerage company or bank. Remember that accountsincluding 401(k) prepares, individual retirement accounts (IRAs), and brokerage accountsare not investments themselves. Rather, they are portfolios that hold the investments you select.

401(k)s and IRAs are tax-deferred accountsmeaning you do not have to pay taxes on the profits that accumulate from the financial investments within them each year. Earnings tax is due just on the cash you withdraw during retirement. In addition, conventional Individual retirement accounts and conventional 401(k)s are moneyed with pretax dollarsmeaning, you get a tax deduction for the deposits the year you make them.

Nevertheless, you pay no taxes on any withdrawals you make in retirement from these accounts. Taxable Accounts Taxable accounts don't incur any sort of tax break. They are moneyed with after-tax dollarsso when you make a deposit, you do not get a deduction. And you pay taxes on any financial investment earnings or capital gains (from selling a financial investment at an earnings) the year you receive it.

However, you can preserve a tax-deferred account like an individual retirement account at a brokerage. Retirement Accounts These retirement plans, also understood as pensions, are moneyed by employers. They guarantee a specific retirement advantage based upon your income history and duration of work. They are progressively unusual today outside of the general public sector., retirement investing basics

#howtoinvestinbitcoin#howdoiinvestinbitcoin#goldco

retirement investing basics

Maine, Maryland, Massachusetts, Michigan, Minnesota, Minor Outlying Islands, Mississippi, Missouri,

MS, MT, NC, ND, NE, NH, NJ, NM,

-

14:15

14:15

Tactical Advisor

8 hours agoNew Ruger Glock Clone | Magpul RXM (FIRST LOOK)

12.8K7 -

7:55

7:55

The Nima Yamini Show

15 hours agoWho Is Controlling Facebook and Instagram? The Truth About George Soros and Meta’s Oversight Board

18.2K26 -

3:45

3:45

BIG NEM

7 hours agoDiscover Your Ikigai: Finding Your Ultimate Purpose

6.5K1 -

13:19

13:19

Dermatologist Dr. Dustin Portela

1 day ago $1.71 earnedDo You Have Sebaceous Filaments or Blackheads?

5.15K1 -

2:21:35

2:21:35

Price of Reason

11 hours agoThe Establishment WORRIES about Elon Musk AGAIN! Superman Trailer Discussion! Sonic 3 Review!

39.6K2 -

1:14:54

1:14:54

Steve-O's Wild Ride! Podcast

14 hours ago $15.64 earnedZac Brown Reveals The Secrets To HIs Success - Wild Ride #247

56.5K12 -

4:16:43

4:16:43

JdaDelete

8 hours ago $11.48 earnedProject Zomboid with the Boys | The Great Boner Jam of 2025

35.5K -

6:00:08

6:00:08

SpartakusLIVE

9 hours agoYoung Spartan STUD teams with old gamers for ultimate BANTER with a SMATTERING of TOXICITY

28.1K -

1:50:39

1:50:39

Kim Iversen

10 hours agoShocking Proposal: Elon Musk for Speaker of the House?! | IDF Soldiers Reveal Atrocities—'Everyone Is a Terrorist'

73.9K163 -

43:27

43:27

barstoolsports

13 hours agoOld Dog Bites Back | Surviving Barstool S4 Ep. 9

130K3