Premium Only Content

Opendoor Chamath IPOB In Talks to List Via Social Capital II Merger Palihapitiya SPAC

Get two free stocks, one valued from $12-$1400 on Webull:

https://act.webull.com/e/5zThWeyNVDe2/0vc/

Wanna be friends? Add Me Here!

https://twitter.com/MoneyOctopus

https://stocktwits.com/OctopusMoneyMultipliers

https://www.patreon.com/octopusmoneymultipliers

Wanna Buy Some Shirts Or Cups?

https://octopusmoneymultipliers.com/merchandise

Wanna Buy The Same Stuff I Use Or Help Support Us By Buying Your Amazon Stuff Through These Links?

My First Camera Stand:

https://amzn.to/318yjuk

My Second Camera Stand:

https://amzn.to/30pfPqr

My Camera:

https://amzn.to/3gqnPgv

Worlds Best Bluetooth Headset:

https://amzn.to/3gtzT0k

What I Use To Put My Camera Stand On To make It The Perfect Height:

https://amzn.to/2Dg4TCL

Buy Silver Gold Platinum Digitally Vault

https://www.onegold.com/join/54902b874e94473d8f7b49fbfbd141a0

Buy Silver Gold Platinum Physically

Want the Best Stock Trading Charting Program?

(Bloomberg) -- Opendoor, a property technology startup, is in advanced talks to go public through a merger with Social Capital Hedosophia Holdings Corp. II, according to people with knowledge of the matter.

Social Capital, the blank-check company led by chairman Chamath Palihapitiya, is discussing raising fresh equity to help fund the transaction with prospective investors, said some of the people, who asked not to be identified because the talks are private.

The combined company would be valued at around $5 billion in the deal, which is expected to be announced in the coming weeks, the people said.

The transaction isn’t yet finalized and talks could still fall apart.

Representatives for Opendoor and Social Capital declined to comment.

San Francisco-based Opendoor, led by Chief Executive Officer Eric Wu, buys homes digitally, makes minor repairs and lists the properties for sale, charging a fee for the service. The company was valued at $3.8 billion in a March 2019 fundraising round, and at the time said it had raised $1.3 billion from investors including Softbank Vision Fund, General Atlantic, Khosla Ventures, NEA and Norwest Venture Partners.

Social Capital, which began trading in April, has seen its stock soar in recent days. It closed Thursday up 49 cents at $12.41 per share and jumped another 14% to $13.55 at 6:59 p.m. in New York in after-hours trading.

(Updates with Opendoor declining to comment in the third paragraph)

For more articles like this, please visit us at bloomberg.com

-

LIVE

LIVE

GritsGG

3 hours ago#1 Warzone Win Grind! 🔥

87 watching -

8:24

8:24

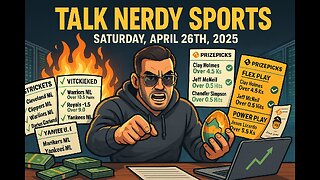

Talk Nerdy Sports - The Ultimate Sports Betting Podcast

3 hours ago4/26/25 - Saturday Annihilation: Vasil’s 8 Sharp Picks and 2 PrizePicks Built for Blood 💥📈

35.1K1 -

LIVE

LIVE

GamingWithHemp

3 hours agoElder Scrolls Oblivion Remastered Episode #2 Ultra high settings

58 watching -

2:11:49

2:11:49

Rotella Games

21 hours agoSaturday Morning Family Friendly Fortnite

22.7K5 -

2:13:45

2:13:45

I_Came_With_Fire_Podcast

12 hours agoRESTRUCTURING THE WORLD- CIVICS CLASS WITH DAN HOLLAWAY

25.4K5 -

DVR

DVR

Bannons War Room

2 months agoWarRoom Live

14.2M3.58K -

LIVE

LIVE

Total Horse Channel

1 day agoYELLOWSTONE SLIDE I | SATURDAY

209 watching -

23:52

23:52

The Rad Factory

6 hours ago $1.79 earnedIs My Formula Race Car Faster Than a Go Kart?

32.3K3 -

20:56

20:56

marcushouse

5 hours ago $2.03 earnedStarship Flight Test 9 Vehicles FINALLY Prepare, and Huge Starbase Upgrades – It's All Happening!

33.4K13 -

23:48

23:48

CatfishedOnline

19 hours agoVictim's Life is Threatened After He Gets in Too Deep With a Crypto Scammer

32.1K4