Premium Only Content

Chris Temple: Biden's Policies to Benefit Uranium

To subscribe to our newsletter and get notified of new shows, please visit http://palisadesradio.ca

Tom welcomes investor and publisher Chris Temple of The National Investor back to the show.

Chris discusses the potential impacts of a Biden presidency with China. Biden's carbon credits and green energy policies will attract Wall Street's attention. If you invest in the right green energy areas, you will make a lot of money in the coming years.

The nuclear energy space is going to do well simply because uranium is such a small market. Recent price action in uranium is just a taste of what is to come.

Due to these green energy policies, the battery metals will do well, and even hydrogen will become a longer term play. He believes Biden will carry forward the energy independence programs that Trump started.

Hopefully, the reductions in red tape around mining and permitting will persist under Biden. Biden is president for the same reason that Kamala Harris is Vice President; they are both 110% establishment.

He discusses the outlook for gold. He says gold sold off because generalist investors looked at the benefits of a Yellen as Treasury Secretary and the coming spending on infrastructure and stimulus. He argues it's more important to follow the generalist investor's actions instead of just gold bugs.

The Fed will continue printing and keep coming up with tricks. Gold will do well going forward depending on how the macro situation plays out in the short term.

He discusses how most asset classes are manipulated, and gold is not an exception. However, he questions the price suppression narrative by reviewing some of the historical price actions of gold.

He discusses why a risk-off environment would cause treasuries, gold, and the dollar to rise.

He argues it doesn't matter who is in power because a generational power structure sets the United States' real policies.

Time Stamp References:

0:00 - Introduction

1:17 -Carbon Taxes Under Biden

5:51 - Uranium Positioning

9:57 - Energy & Mining

13:22 - Gold Macro Factors

18:26 - Gold Manipulation

24:24 - Factors to Move Gold

27:46 - Risk-Off Environment

31:15 - Politically Neutral

Talking Points From This Episode

- Biden and Green Energy

- Uranium and Nuclear

- Gold Outlook and Manipulation

- Possible risk-off environment coming.

Guest Links:

Twitter: https://twitter.com/NatInvestor

Facebook: https://www.facebook.com/TheNationalInvestor/

Website: https://nationalinvestor.com/

Website: https://www.economiclifeboat.org/

Chris Temple is the editor and publisher of The National Investor where his focus is teaching his audience how to build an economic lifeboat while finding excellent opportunities. Chris has distinguished himself as an "outlier," and that strategy has served his audiences well over the years. Mostly self-taught, Chris has studied the modern monetary system extensively over the past four-plus decades.

He distinguishes the knowledge he provides from the oceans of mere information (and much disinformation) that people typically have to wade through. Armed with that knowledge, he has succeeded in saving his audience and subscribers from every significant market decline. Chris explains how in his signature essay entitled "Understanding the Game." When you truly understand what makes the markets and financial system "tick," it's not that difficult.

He has been recognized widely as possessing the talent to find undervalued companies in many different industries and often recommend them before others.

Chris calls the period we are in now "The Strange Depression." He says, "It is more important than ever to start insulating ourselves from the crumbling top-down system." Chris takes a more upbeat approach to share his ideas, strategies, and resources.

#ChrisTemple #NationalInvestor #Gold #Uranium #Biden #GreenEnergy #Carbon

-

51:00

51:00

Palisades Gold Radio

5 days agoJesse Felder: The Darkening Skies Over Wall Street - Ominous Signals for Investors

427 -

12:06

12:06

Sean Hannity

2 years agoHannity: Biden's policies are a disaster

1.45K20 -

7:34

7:34

One America News Network

2 years agoBiden's disastrous oil policies are collapsing US

1.07K23 -

1:11

1:11

Mr Producer Media

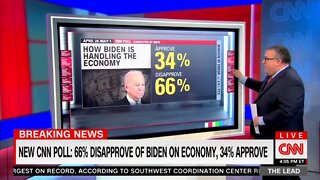

2 years agoCNN Poll: Biden's Policies WORSENED Economic Conditions

2413 -

0:31

0:31

Danielle D'Souza Gill

2 years agoAmericans SHRED Biden's Gas Policies

831 -

0:56

0:56

Americas Voice Live

2 years agoFighting Back Against Biden's Policies

2081 -

0:55

0:55

Ron DeSantis

2 years agoBiden's Border Policies Are Failing

53212 -

9:38

9:38

John Fredericks Media Network

2 years ago $0.04 earnedCaller Chris: Biden's war on truckers

35 -

4:05:35

4:05:35

TheNateVibez

10 hours agoOmni-🤖 - First Rumble Stream.🫡 - VETERAN

56K3 -

2:59:26

2:59:26

Tundra Gaming Live

15 hours ago $5.09 earnedThe Worlds Okayest War Thunder Stream//FORMER F-16 MAINTAINER//77th FS//#rumblefam

33.9K1