Premium Only Content

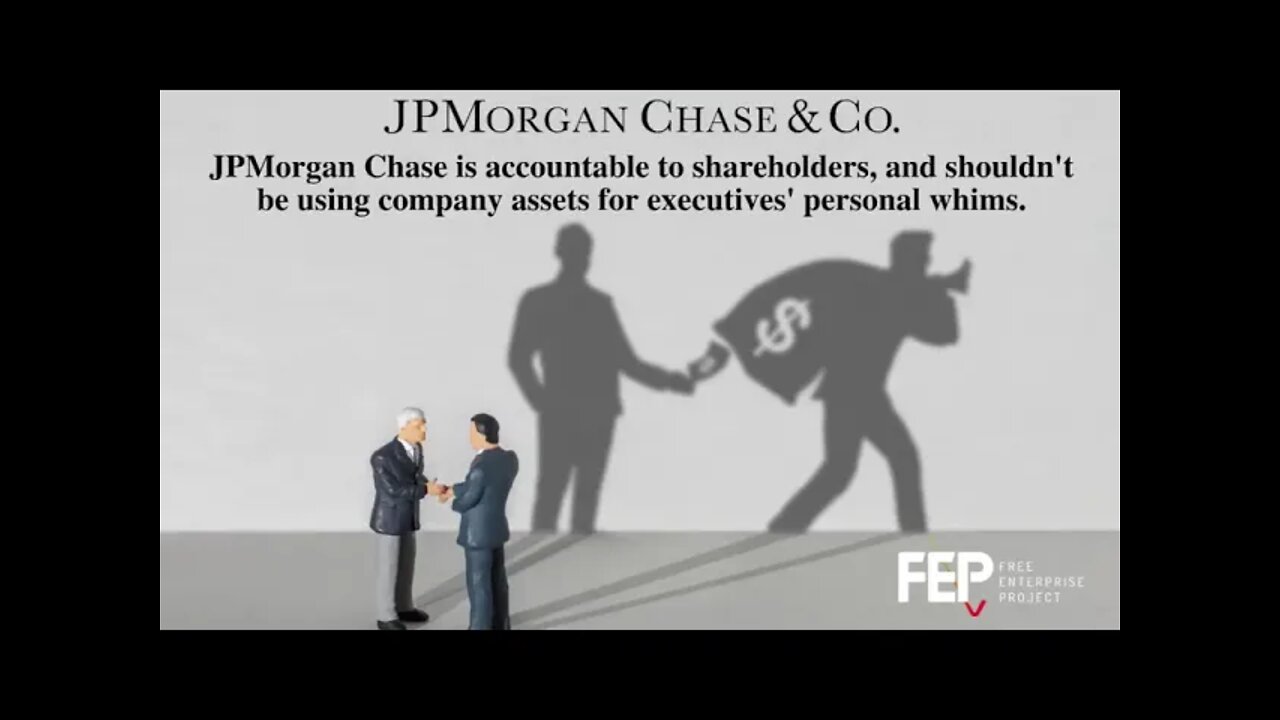

JPMorgan Chase is Accountable to its Shareholders - Yet Executives Spend Money on Personal Interests

At the JPMorgan Chase annual shareholder meeting on May 17, 2022, Free Enterprise Project (FEP) Associate Ethan Peck presented a shareholder proposal targeting JPMorgan's embrace of so-called "stakeholder capitalism." Ethan's remarks can be heard here, and are also below.

The board recommends a vote against our proposal to become a Public Benefit Corporation. Well… we agree, and also ask that you vote “no” to Proposal 8.

JPMorgan Chase & Co. should *not* be a Public Benefit Corporation. But… if it’s going to remain a conventional Delaware corporation – as we recommend – then it must also abide by the legal obligations that that entails. Namely, that the board has a fiduciary responsibility to its shareholders over any outsiders (outsiders who have been rebranded as “stakeholders”).

This is relevant because JPMorgan adopted the Business Roundtable Statement that explicitly redefined the purpose of a corporation from the traditional and legally required rule of shareholder primacy to the idea of serving all “stakeholders.” And the justification, they claim, is public betterment.

But the board can’t have it both ways – and that is… be incorporated as a conventional Delaware corporation, but then behave as a Public Benefit Corporation by adopting the stakeholder model.

Only it’s worse than that still. Because at least public benefit corporations may occasionally benefit the public. But the stakeholder scam only pretends to. And that pretending gives cover for corporate boards to decide who qualifies as a stakeholder and who doesn’t. Is it really a surprise then when corrupt bureaucracies and special interest groups are the primary stakeholders?

The stakeholder scam was first introduced in the 1970s by World Economic Forum founder Klaus Schwab. In recent years, BlackRock and its politically self-dealing CEO Larry Fink – who is uncoincidentally on the board of the World Economic Forum – has also pushed for corporate boards to adopt the stakeholder model. The same goes for Vanguard and State Street.

This is relevant because JPMorgan is a partner of the World Economic Forum, and its top 3 shareholders are Vanguard, State Street, and BlackRock… all of which also own each other.

It’s one big incestuous party for the elite managerial class and the retail investor isn’t invited… but he is paying for it.

Stakeholder capitalism is only half the scam – sure it provides cover for corporate boards to shift their obligations away from shareholders, but it is ESG which dictates to boards which stakeholder interests they must serve.

ESG is essentially a CCP-style social credit system for corporations. By shifting responsibility to stakeholders, and then tailoring what that responsibility entails through ESG, corporations have effectively become radical political actions groups with real governing power over the lives of everyday individuals.

Last I checked, we still live in a self-governing republic. That power belongs to the people to adjudicate amongst themselves… not to self-appointed oligarchs like Klaus Schwab, Larry Fink, or you, Mr. Dimon.

By adopting the stakeholder model and capitulating to ESG – which is plagued by woke nonsense – JPMorgan has participated in this scam against everyday Americans on the shareholder dime. If JPMorgan truly sees itself as a corporation aimed at serving the public, then it is doing a terrible job.

So we agree – JPMorgan isn’t fit to be a public benefit corporation. Vote against proposal 8, but also join us in demanding that JPMorgan Chase & Co. stick to banking and obey its legal obligation to its shareholders.

For more information, see http://freeenterpriseproject.org.

-

2:00:10

2:00:10

Bare Knuckle Fighting Championship

3 days agoCountdown to BKFC on DAZN HOLLYWOOD & FREE LIVE FIGHTS!

42.6K3 -

2:53:01

2:53:01

Jewels Jones Live ®

1 day agoA MAGA-NIFICENT YEAR | A Political Rendezvous - Ep. 103

100K24 -

29:54

29:54

Michael Franzese

12 hours agoCan Trump accomplish everything he promised? Piers Morgan Article Breakdown

104K49 -

2:08:19

2:08:19

Tactical Advisor

16 hours agoThe Vault Room Podcast 006 | Farwell 2024 New Plans for 2025

178K11 -

34:12

34:12

inspirePlay

1 day ago $5.45 earned🏆 The Grid Championship 2024 – Cass Meyer vs. Kelly Rudney | Epic Battle for Long Drive Glory!

80.3K8 -

17:50

17:50

BlackDiamondGunsandGear

13 hours ago $2.61 earnedTeach Me How to Build an AR-15

54.9K6 -

9:11

9:11

Space Ice

1 day agoFatman - Greatest Santa Claus Fighting Hitmen Movie Of Mel Gibson's Career - Best Movie Ever

114K47 -

42:38

42:38

Brewzle

1 day agoI Spent Too Much Money Bourbon Hunting In Kentucky

76.6K12 -

1:15:30

1:15:30

World Nomac

22 hours agoMY FIRST DAY BACK in Manila Philippines 🇵🇭

59.1K9 -

13:19

13:19

Dr David Jockers

1 day ago $11.27 earned5 Dangerous Food Ingredients That Drive Inflammation

78.3K17