Premium Only Content

FUDSTOP, Charlie makes a prediction that could make you a millionaire!

Libor is huge. … and its going away

LIBOR underpins more than 400 trillion of financial products including retail mortgages, private student loans, corporate loans, derivatives and other financial products

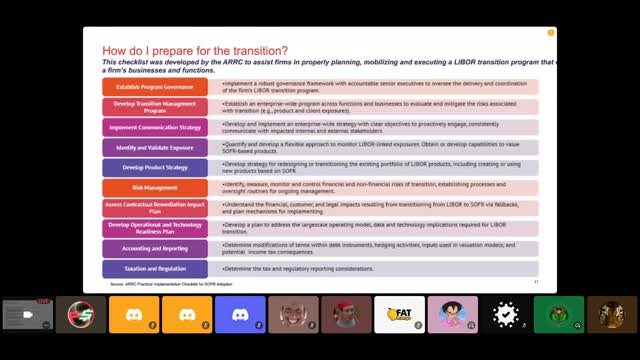

There were a couple of bad actors that were manipulating and the regulators wanted to fix LIBOR so they wanted to fix this whole issue but at its core, the interbank lending market no longer exists. They wanted to deem libor nonrepresentative because it can’t be fixed and its not based on real transactions. We have panel banks that there aren’t real trades for me to base my rates. And why would I subject myself to fines that I’m not responsible for. So alexander brought all the panel banks to the table and submitted that all banks would continue to use LIBOR until the end of 2021. So when we talk about LIBOR transition, the way we refer to it and after 2021 we aren’t guaranteeing that we would submit LIBOR quotes. There are some newsday articles that are suggesting that there may be clarity but its not a guarantee. In the US MARKET, goodbye LIBOR, HELLO SOFR. In June 2017, the ARRC identified the secured Overnight financing rate (SOFR) as its preferred alternative for USD LIBOR

-Secured: ased on trades in the triparty, cleared bilateral and certain other US treasury repo markets

-Overnight: The rep rates used are overnight and reflect borrowing for one business day

-Financing Rate: Represents secured funding costs for financial institutions pledging US Treasuries

The reason SOFR is surpassing 800 billion in trades because it represents the United States Repo market, it’s the deepest and most liquid borrowing market in the US and its based on its secure trades. We will continue to see people transact in fully secure treasuries. However, that’s a very different rate from LIBOR. Libor is based on an uncollatarized rate vs SOFR which is secured overnight repo rate. There are various tenors, all forward-looking. The challenge in order to derive a forward looking termrate and still be compliant after the financial crisis.

Some of the critique of the SOFOR there is some volatility, in September in 2019 there was a tremendous spike in the repo market, you had tax time, and effectively you didn’t have the right match in supply and demand.

So lets focus on what happened this year. There was a speak divergence between LIBOR vs SOFR. What you can see here very clearly as the, we saw SOFR decrease, we saw fed rate decrease, and we saw LIBOR increase. So as a borrower, I think that the preference is that something that moves with the fed rate. You want something that is lower and you don’t want something that spikes during a correction.

The reality is that LIBOR is going to cease to exist as a credit entity and the transition is going to be going into SOFR

Does the shift to SOFR mean that the FED will be administrating the Fed rate?

Yes, it is planning to continue to administer the rate. No one is going to think that the FED is going to engage in any manipulation.

The people there are saying that everyone is getting out of tech and that people are betting on a bear market. There is no reason other than headlines that you would want to do that. The fact that it is so obvious makes it suspect.

Its going to get harder and harder to find them when the repo starts to come down.

I’m pretty sure some of these stocks

SOFR is the repo, they’re trying to transition from LIBOR into SOFR.

Hang Seng is really tech weighted, but its mixed with a lot of consumer shit too. Its more like the DOW than the SPY.

“After the three red lines eased look at the SPY and the daily

And the ishares and the emerging markets fund. THE PCR volume is ridiculous. Nothing else even comes across in the market.

And then why are they lending them AAA lending vehicle. And the senate is all in on BABA. Are you fucking kidding me? They are front running this shit like ridiculous.

“I’m trying to catch up. Whats the metaverse thing?”

Charlie, “Its like we’re going to have peer to peer data we’re going to own nothing and we’re going to be happy. Its this pipe dream where we are all in this special world. And they’re about to start, we’re going to be seen as a set of data. Its all peer to peer data. They’re going to sell you on all this different type of shit. We’ve still played the game right. These things are investments, you’re getting at the bottom of their market for the first time. Whats the timeline to load up on China Shares, we’ve all predicted in April, it’s a little bit delayed for whatever reason the SFT, they withdrew it and they reset the clock. And they have to get the volume at a certain. And when

“Well now you gotta think, there are only gaps on the upside to fill?”

I’m all in on this shit as well too.

If they can kick it, they’re going to delay it until October. Maybe they’re scared of IV crush.

“do you see what happened to the Nasdaq, none of the Chinese stocks, and CD finished 9% of the green on the same day that the NASDAQ shit itself”.

-

UPCOMING

UPCOMING

Sports Wars

40 minutes agoBengals STAY ALIVE In OT Thriller, ESPN's Ryan Clark SLAMMED, NFL DESTROYS NBA On Christmas

-

9:37

9:37

EvenOut

18 hours agoThe Non-Reflecting Mirror Scare Twin Prank!

731 -

11:19

11:19

Tundra Tactical

17 hours ago $0.15 earnedI Saw How CMMG Makes Guns.

5473 -

15:34

15:34

Misha Petrov

12 hours agoReacting To TikTok’s Most DELUSIONAL Takes!

1.29K9 -

1:52:24

1:52:24

Squaring The Circle, A Randall Carlson Podcast

1 day ago#032 Flournoy Holmes' Artwork Helped Define The Southern Rock Phenomenon of The Early 1970's

1.83K2 -

19:56

19:56

inspirePlay

1 day agoWalking with Lions & Facing Africa’s Wild Side | Safari Adventure with the Grid Championship Crew!

7 -

10:50

10:50

RTT: Guns & Gear

1 day agoBudget Friendly Carry 2011: EAA Girsan Brat 2311

2181 -

3:49:06

3:49:06

Alex Zedra

14 hours agoLIVE! New Game | Nuclear Nightmare

87.1K11 -

25:08

25:08

MYLUNCHBREAK CHANNEL PAGE

1 day agoUnder The Necropolis - Pt 2

270K62 -

1:45:59

1:45:59

Spittin' Chiclets

1 day agoCanadian Chokejob - Game Notes Live From Chicago - 12.28.2024

251K31