Premium Only Content

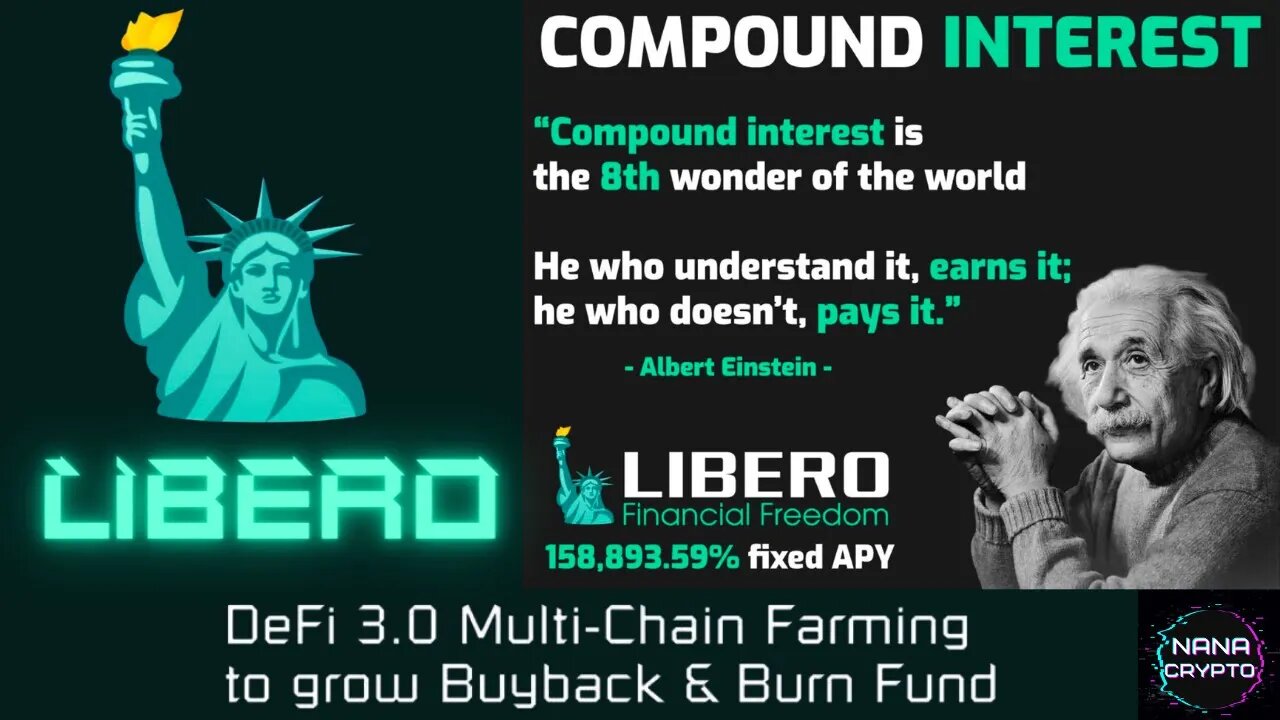

Libero Financial Overview | My Strategy With Libero 🚀

Libero Financial Overview | My Strategy With Libero 🚀

In today’s video, I'll go over Libero Financial and a way I'm planing to earn with the protocol.

🔥 Libero Financial Website: https://nanacrypto.com/Libero

🔥 Libero Telegram: https://t.me/liberoofficialgroup

🔥 Libero Docs: https://docs.libero.financial/

🔥 Libero Twitter: https://twitter.com/LiberoFinancial

🧬 Follow NaNa Crypto on Twitter for early updates and news: https://twitter.com/NaNaCrypt0

LIBERO = Financial Freedom 🗽🗽🗽

Highest Paying Dual Rewards Auto Staking Protocol

Highest Fixed APY in Crypto 158,893.59%

Plus 226% BUSD APR passive income from Trading Volume

Certik Audited

The Libero team focused on innovation that creates benefits and value for Libero token holders. The LAP protocol which is used in the Libero token gives exceptional benefits for holders of $LIBERO:

Easy and Safe – We provide auto staking, right in your wallet, when you purchase $LIBERO, therefore, there is no need to move your tokens to our website. From the minute you buy, you are staked, and set to receive rebase rewards. The easiest auto-staking in DeFi.

158,893.59% APY, the highest Fixed APY on all blockchains – APYs that fluctuate means you can never tell how many tokens you will receive. Other DeFi protocols pay out a high APY that can fluctuate by 90% in a day. LAP pays $LIBERO holders a fixed interest rate of 2.04% daily or with compounding 158,893.59% annually, which tops the industry.

Fast Rebase Rewards every 30 minutes. Other popular staking protocols pay rebasing rewards every 8 hours which means if you want to unstake you have to time it to get maximum rewards. The Libero Auto-staking Protocol pays every 30 minutes or 48 times every day, making it the fastest auto-staking protocol in crypto.

Price floor supported by Defi 3.0 multichain farming profit: We will use the buy&sell tax to create the Libero Insurance Treasury fund and the treasury fund to multichain farming. The LIT funds are bridged to other EVM-compatible blockchains - like Avalanche, Fantom, Solana, Metis, Polygon, etc. to farm at the highest APY farms and the profit returned to the LIT fund. We aim to deliver ~50% additional returns a year or more to better support LIBERO price floor. We are confident that we can support 50% higher APY than other high APY projects while still be sustainable.

DISCLOSURE: A few of the above links are affiliate links. I may earn a commission if you click through and engage with the links/make a purchase. Please keep in mind affiliate commissions are an awesome way for you to support the channel and help me grow as a creator. All the links I post are links I personally use; I will not post links for anything I do not use!

I AM NOT A FINANCIAL ADVISOR AND THIS IS NOT FINANCIAL ADVICE, PLEASE DO YOUR OWN RESEARCH!

As always, thank you so much for watching and if there is anything you would like for me to do a video on just comment the topic below!

#LiberoFinancial #Libero #AutoCompoundInterest

-

LIVE

LIVE

SwitzerlandPlayIT

2 hours ago🔴 Easy Going Saturday - The Next Generation?

28 watching -

23:23

23:23

MYLUNCHBREAK CHANNEL PAGE

17 hours agoAustralia Was Found

13.2K19 -

LIVE

LIVE

ThePope_Live

1 hour agoComing out of retirement for Rebirth Island with @IcyFPS

383 watching -

LIVE

LIVE

BigTallRedneck

1 hour agoFORTNITE - SOLO GRIND FOR OPAL PICKLE

12 watching -

LIVE

LIVE

smokenfiretv

5 hours agohappy Saturday

82 watching -

16:13

16:13

Russell Brand

1 day agoBill Maher EXPOSES Covid Lab Leak Lies LIVE ON AIR

97.7K305 -

LIVE

LIVE

Eternal_Spartan

2 hours agoLive Now! | Join The Channel on a New Adventure In Skyrim PC (Slight Mods) - USMC Veteran!!!

481 watching -

Jewels Jones Live ®

2 days agoTRUMP’S AGENDA ADVANCES | A Political Rendezvous - Ep. 116

32.7K18 -

LIVE

LIVE

IamTyrantt

2 hours ago $2.24 earnedGaming on Rumble!!

131 watching -

1:51:47

1:51:47

Steve-O's Wild Ride! Podcast

2 days ago $5.39 earnedBryan Johnson Helps Steve-O Rebuild His Body After Decades Of Abuse

29.9K9